Money Management Software | Georges Budget for Excel v14

Money Management Software | Georges Budget for Excel v14

Couldn't load pickup availability

- Extra 10% off with code SHOPSAVE10

- 10,000+ customers

- Spreadsheet Created by Owner

- One-Time Purchase: No Subscription

- Instant Download

- Fast Support: Based in USA

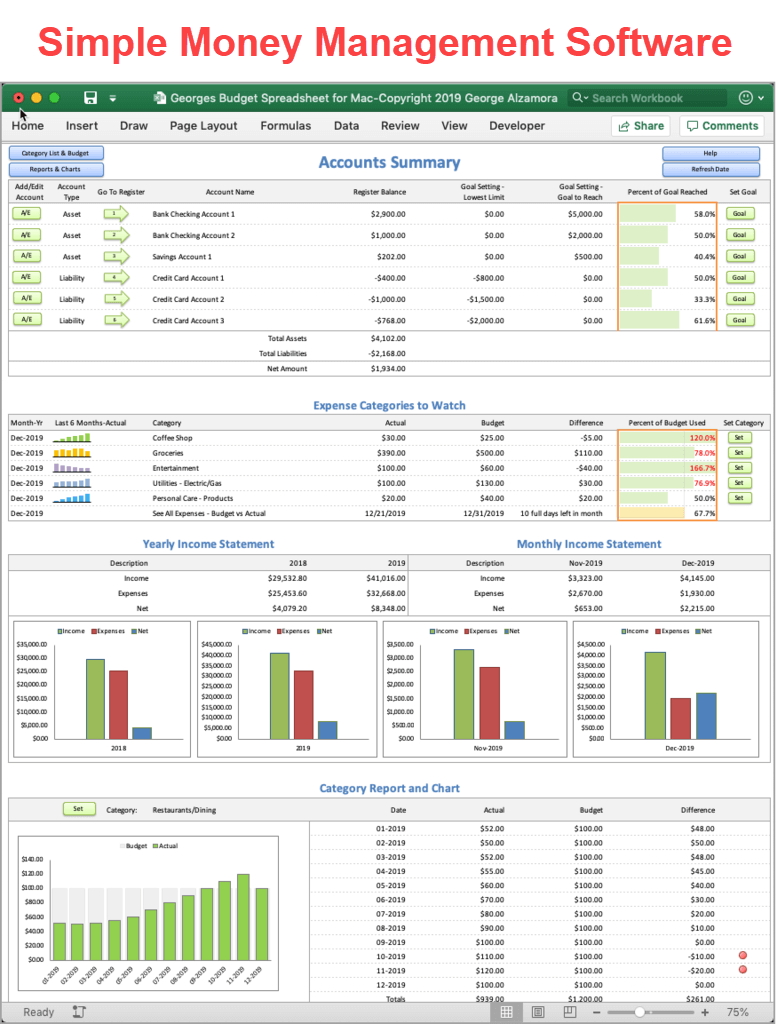

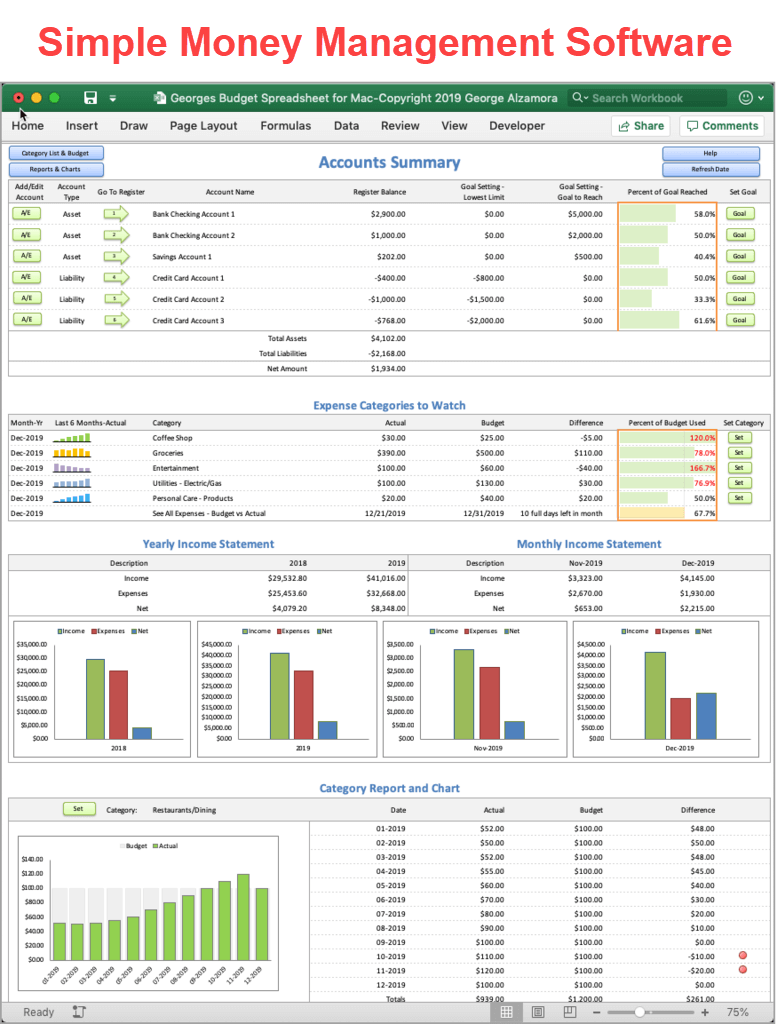

Money management software to create a home budget spreadsheet (budget tracker), track expenses and income to help you cut expenses, pay off debt, save money, and build wealth.

Benefits: (watch video ![]() below for overview)

below for overview)

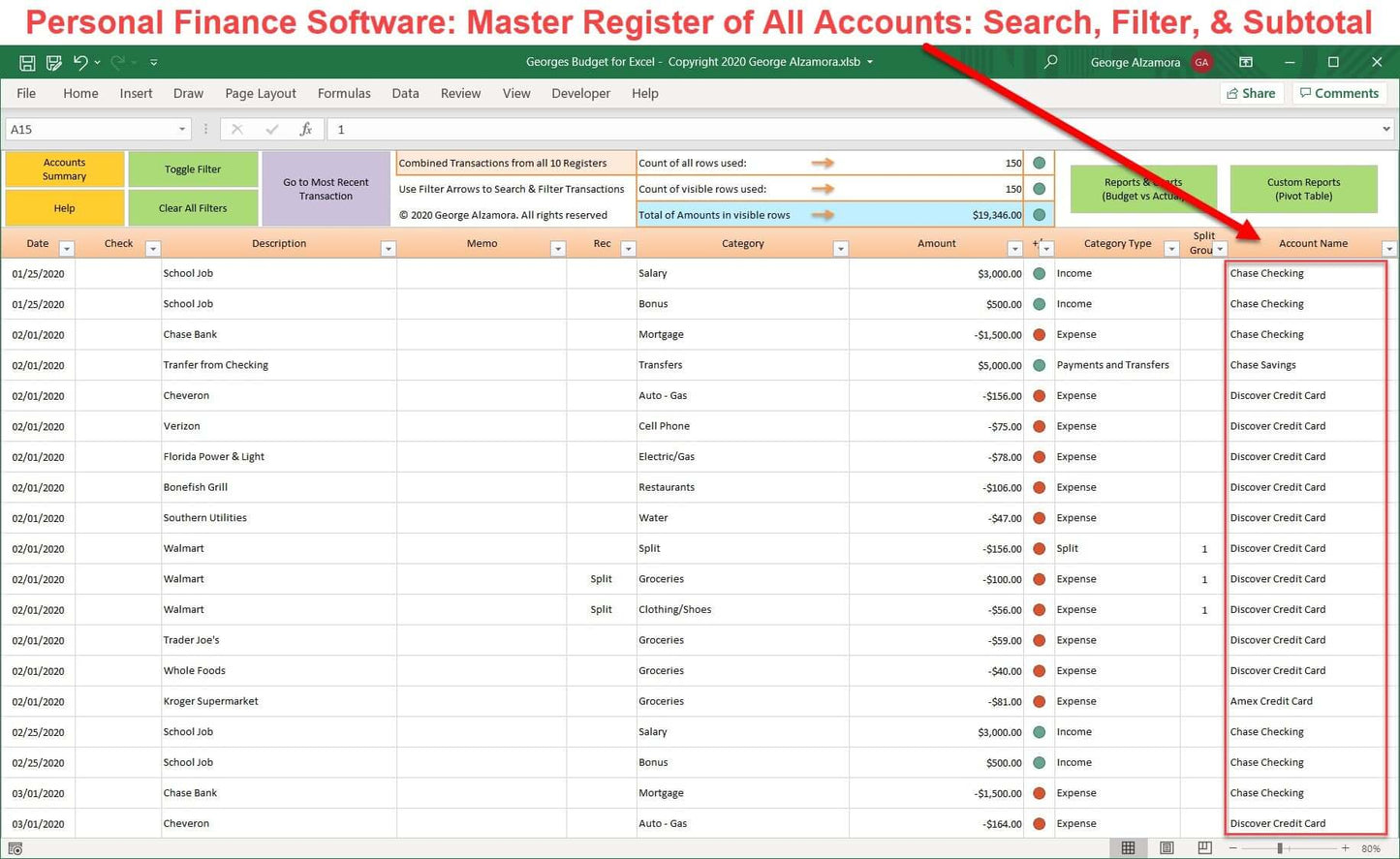

- Track multiple accounts in the account registers: checking accounts, savings accounts, credit cards accounts, etc. You can track up to 10 financial accounts.

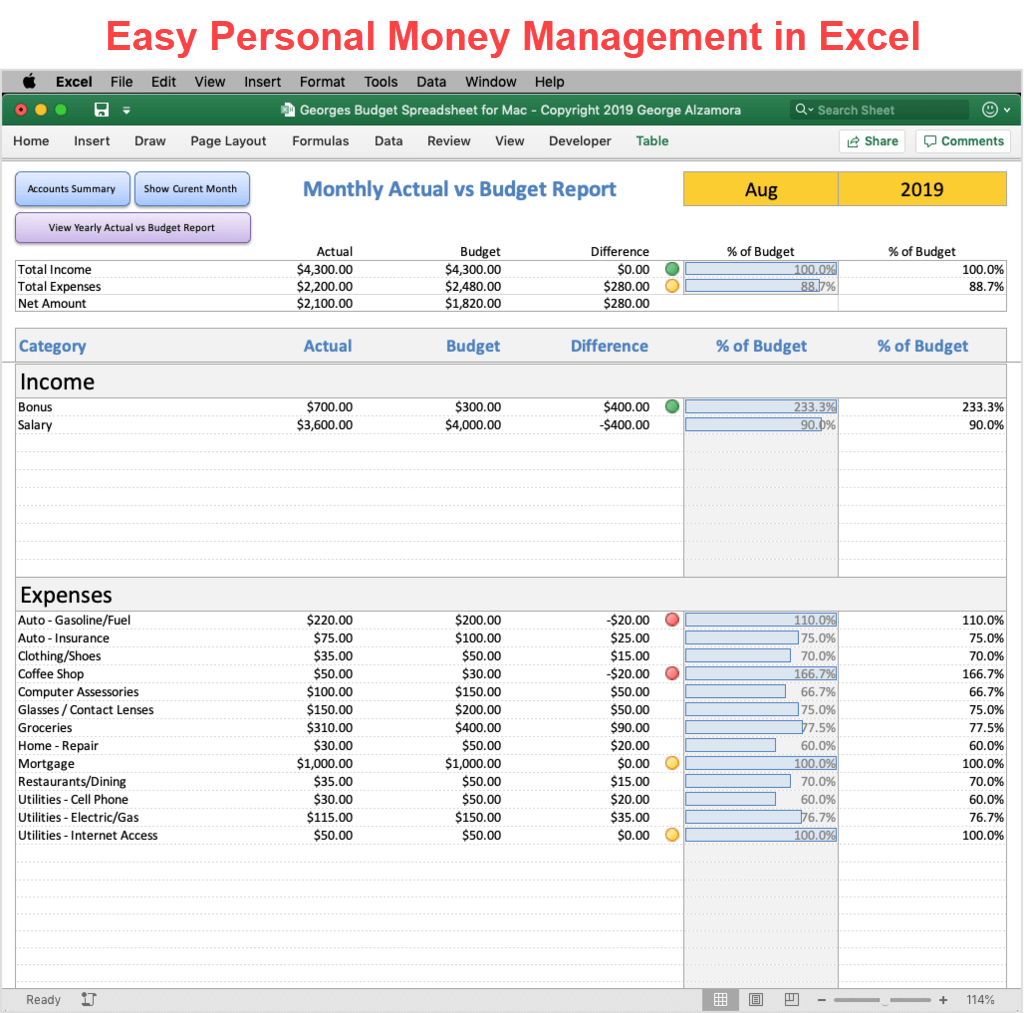

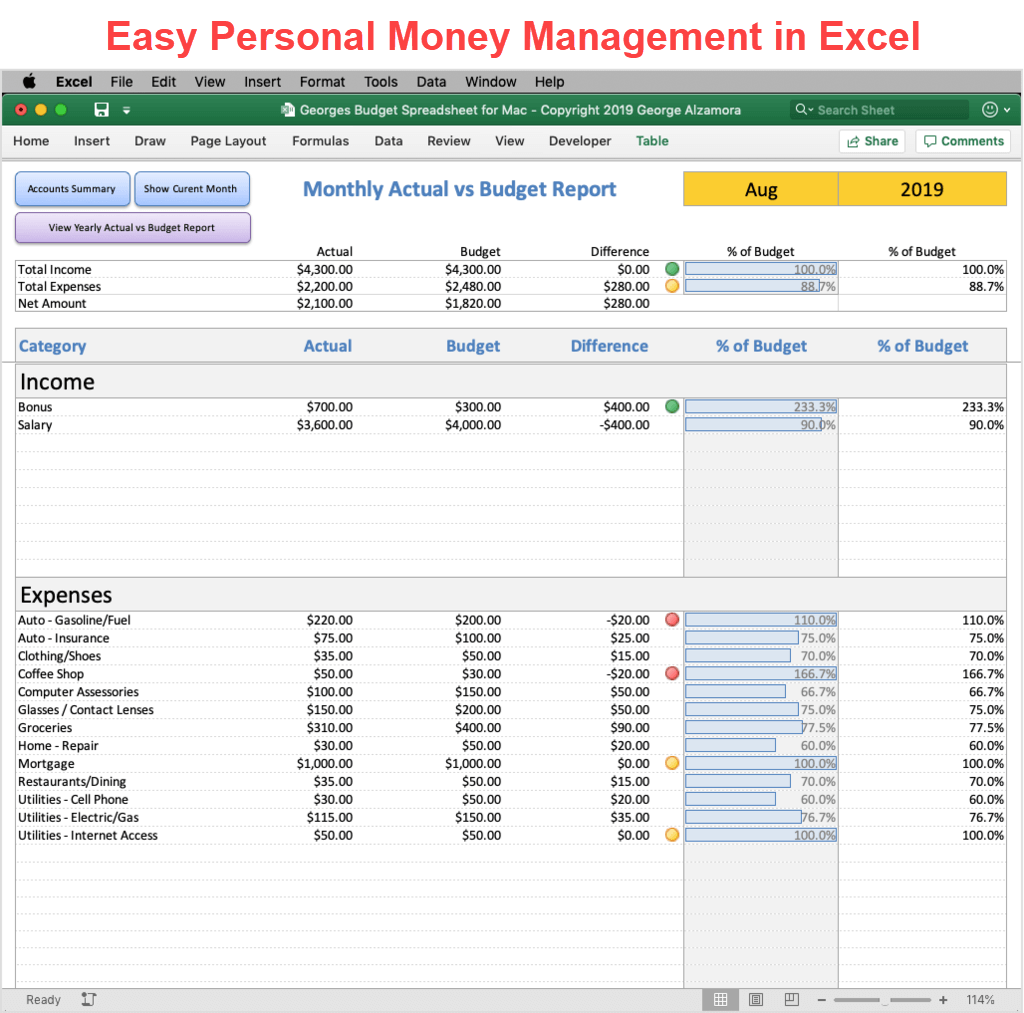

- Create monthly budget and compare to your actual expenses to help you see where you need to reduce expenses, thus helping you save money to pay off debt.

- Set savings goals to help grow your cash and build your wealth such as creating a savings account cash balance goal to reach for emergency funds, large expenses (such as buying a new or used car), future medical expenses, or special purchases that you may not typically create a monthly budget for.

- Set credit card balance goals to help you pay off your credit cards and pay off your debts to help you get out of debt.

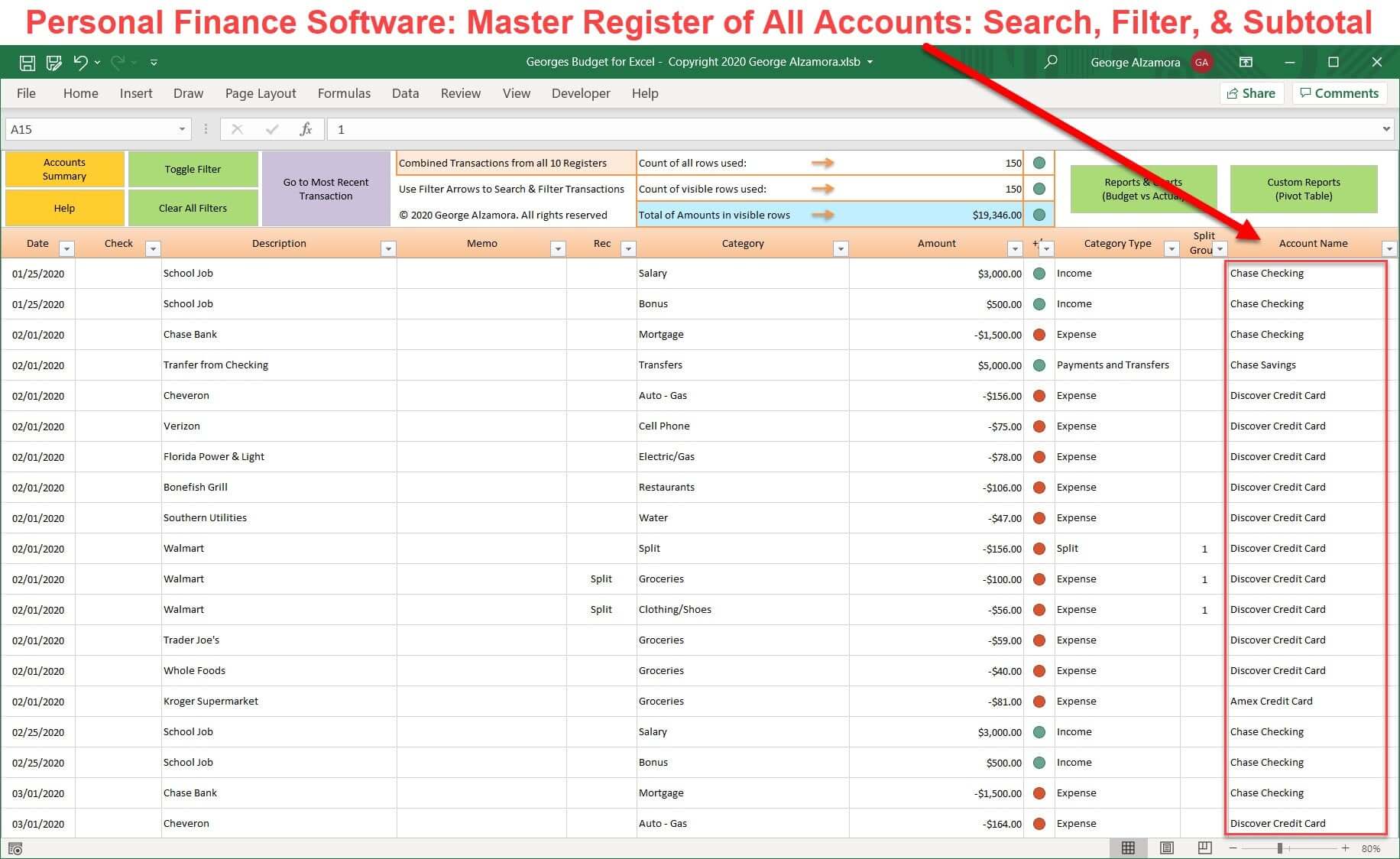

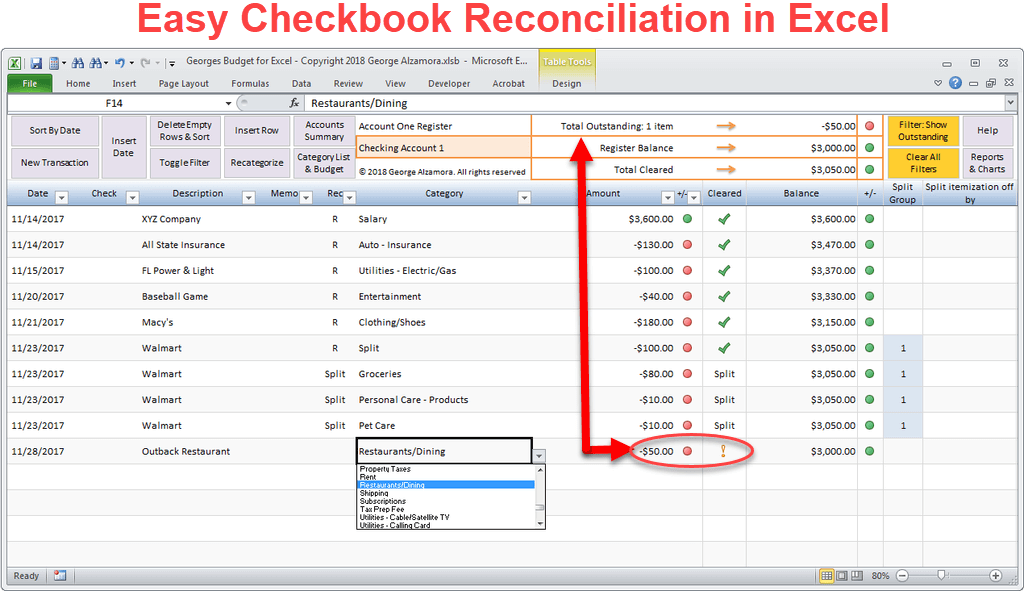

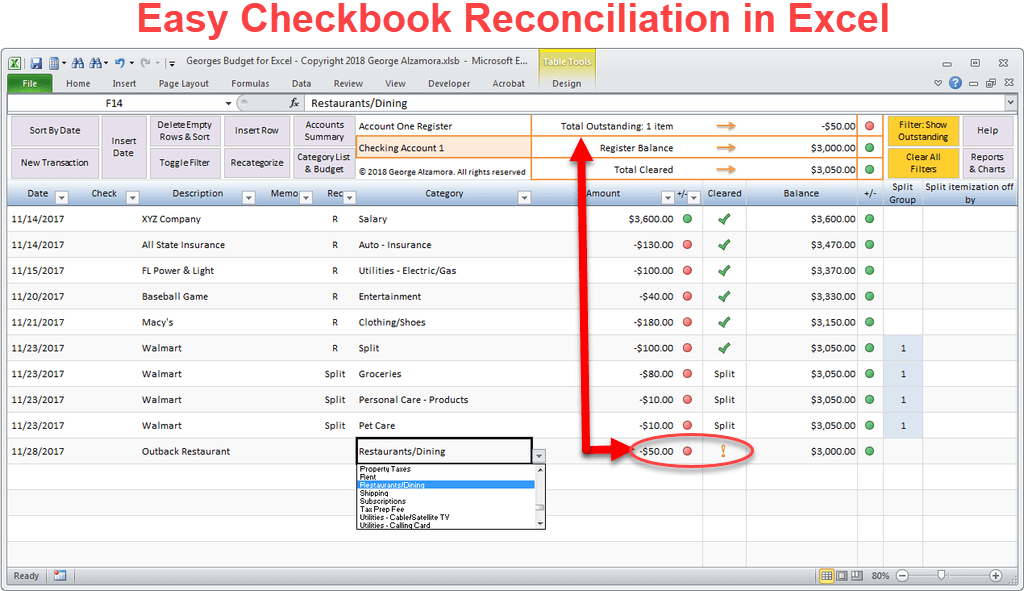

- Split transactions in the registers whether a checkbook register or credit card register so you can better reflect your spending among different spending categories when you make a purchase. A single transaction (such as a purchase at Costco warehouse club or Kroger's) can be split into multiple spending categories such as part groceries and part clothing.

- Simple and visual bank account reconciliation to make sure you know that your financial transactions are correctly recorded in the checkbook registers, credit card registers and with your local bank or credit card company and that your account balance is accurate.

- Makes manages your money easy and fun: Just record your transactions in the checkbook registers or credit card registers and assign them to an income or expense category. Set a monthly budget for each category. Compare your budget to actual with easy to see charts and reports. With this data, makes adjustments to your personal finances such as making spending cuts, or finding ways to increase your income to meet your savings goals and credit card pay off goals, thus allowing you to save more money and grow your wealth, net worth, and assets.

New features in Georges Budget for Excel v14:

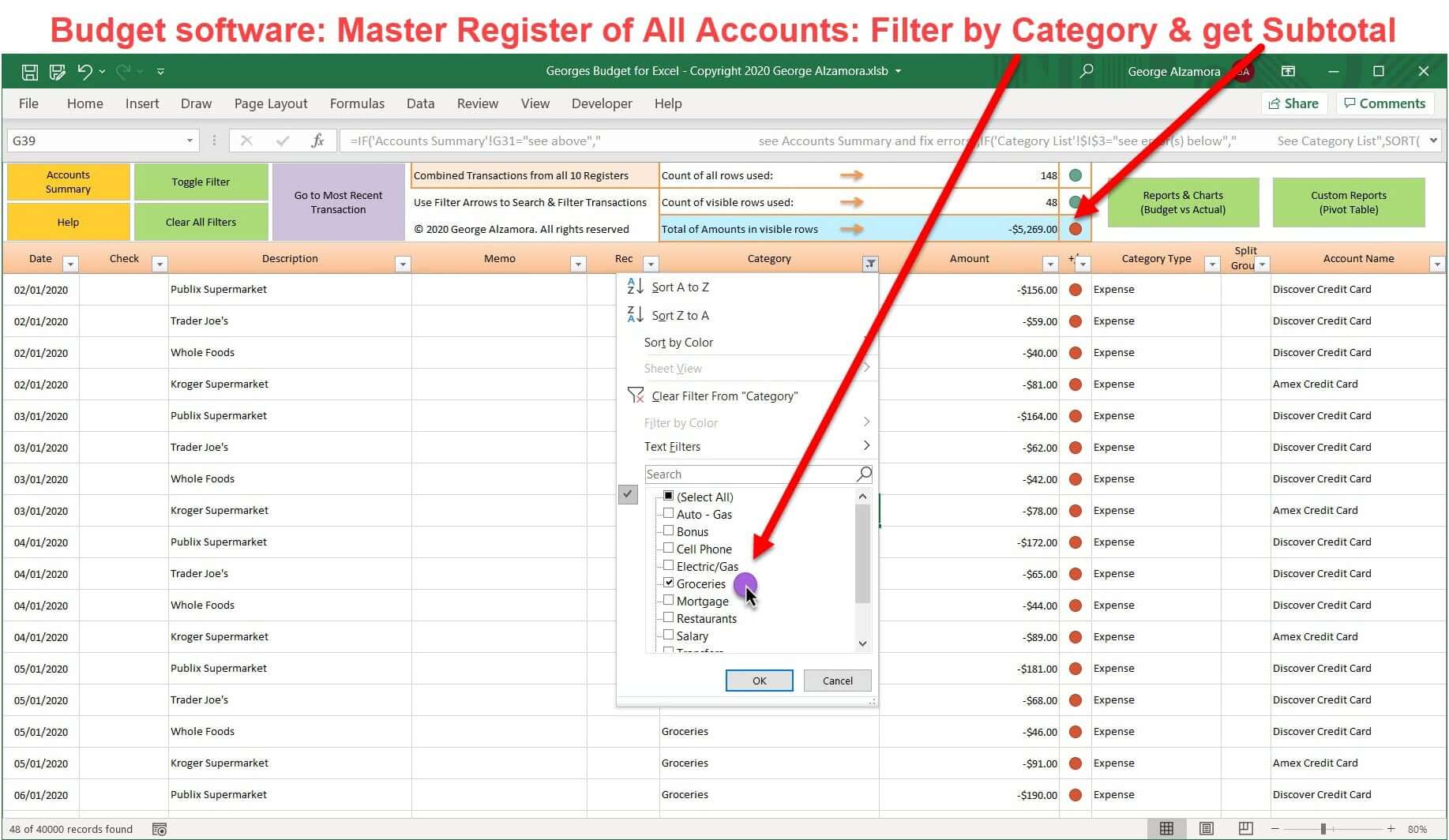

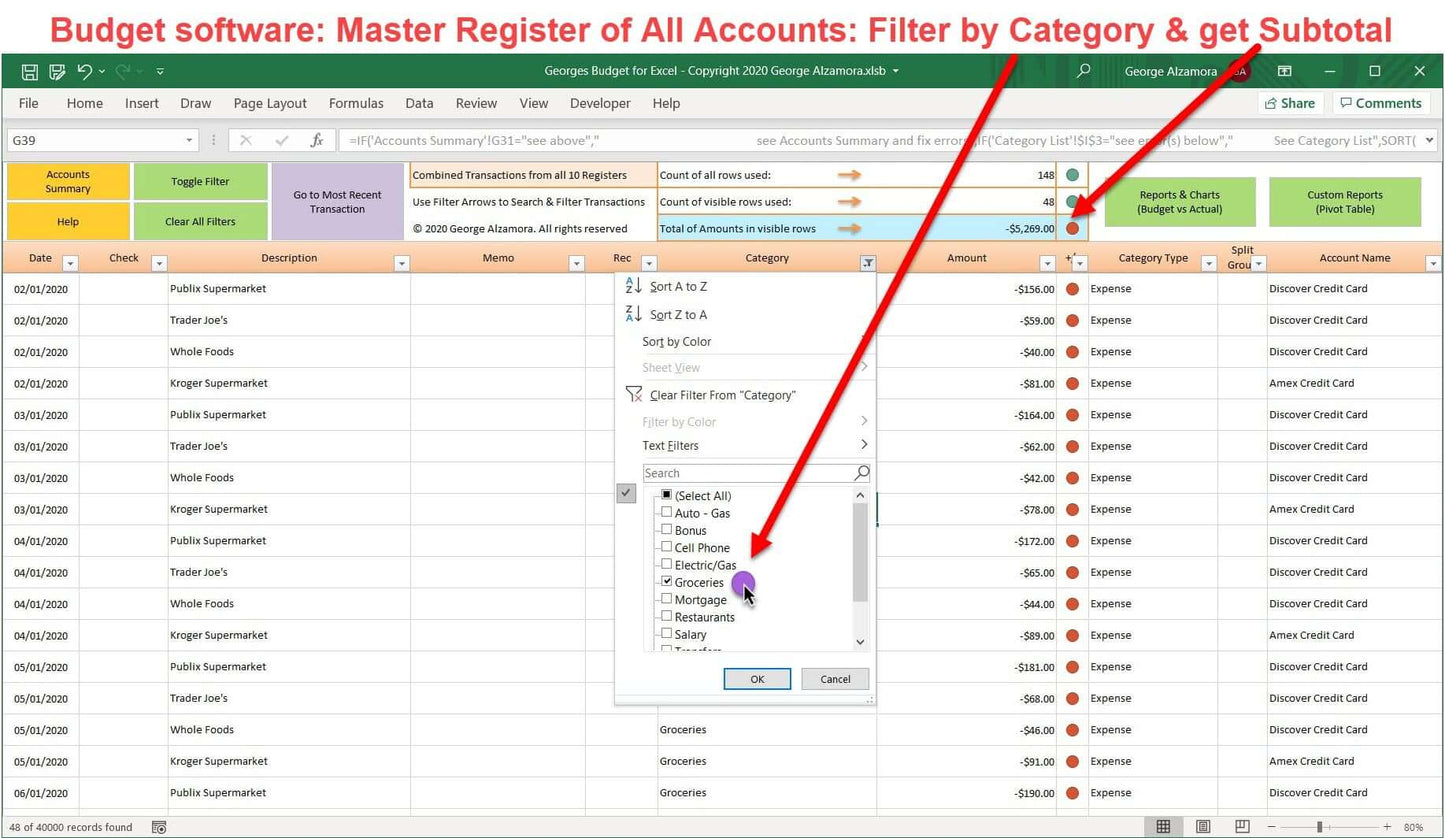

- New master register of all transactions from all 10 accounts/registers combined which you can use to search, filter and get subtotals such as total spent on groceries across all accounts or specific accounts. This master register is automatically created as you enter transactions in one of the 10 separate accounts/registers.

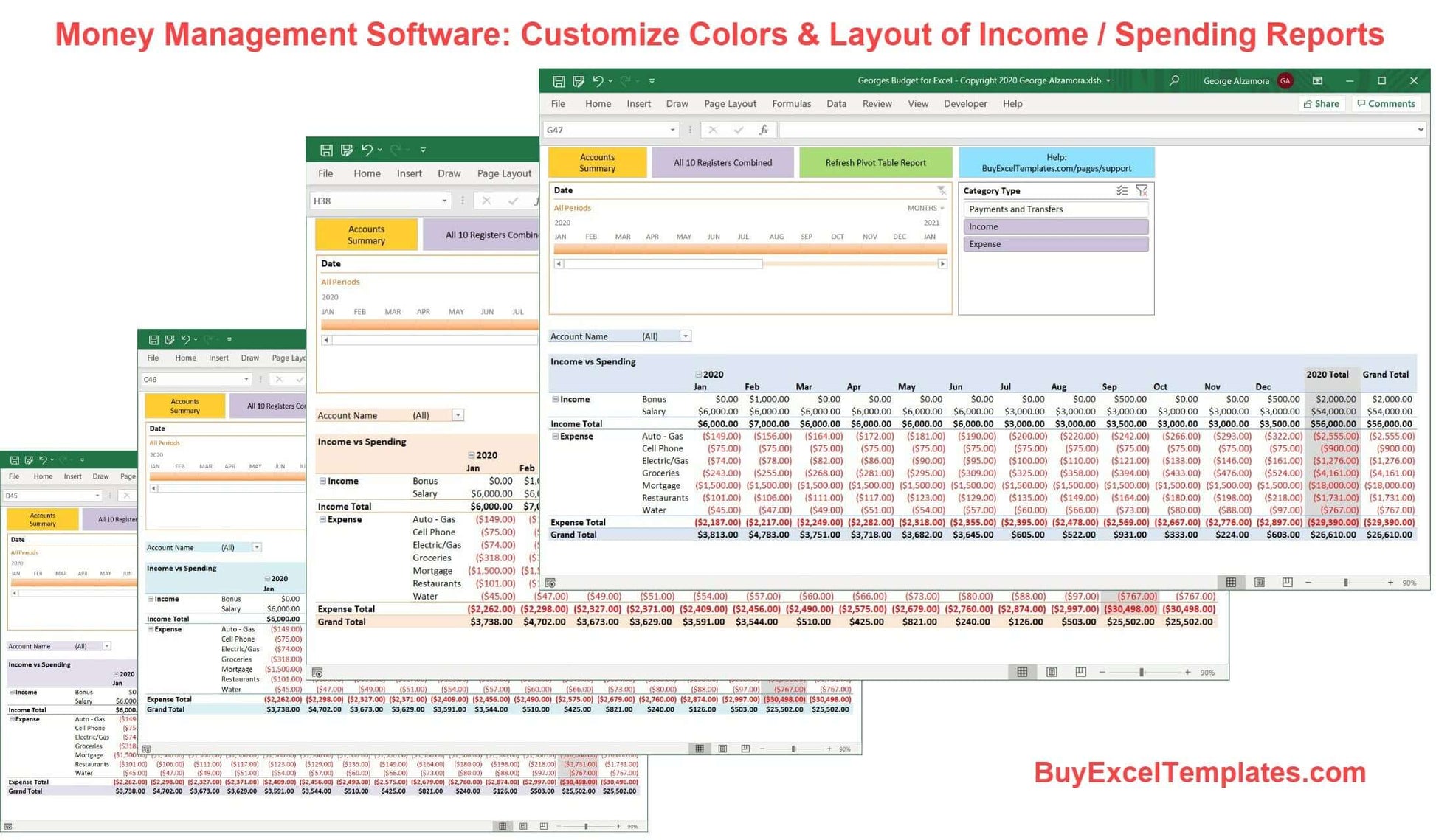

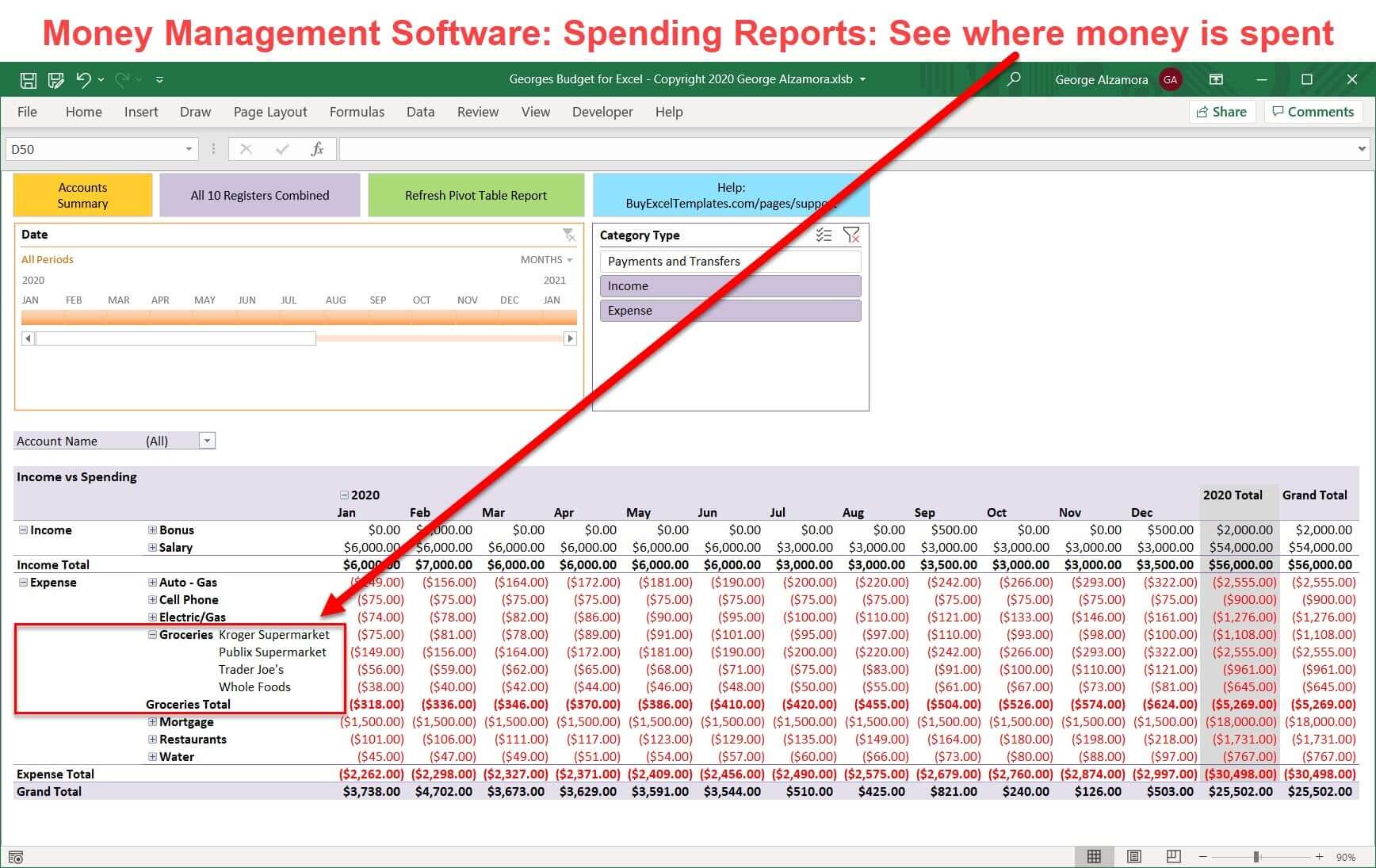

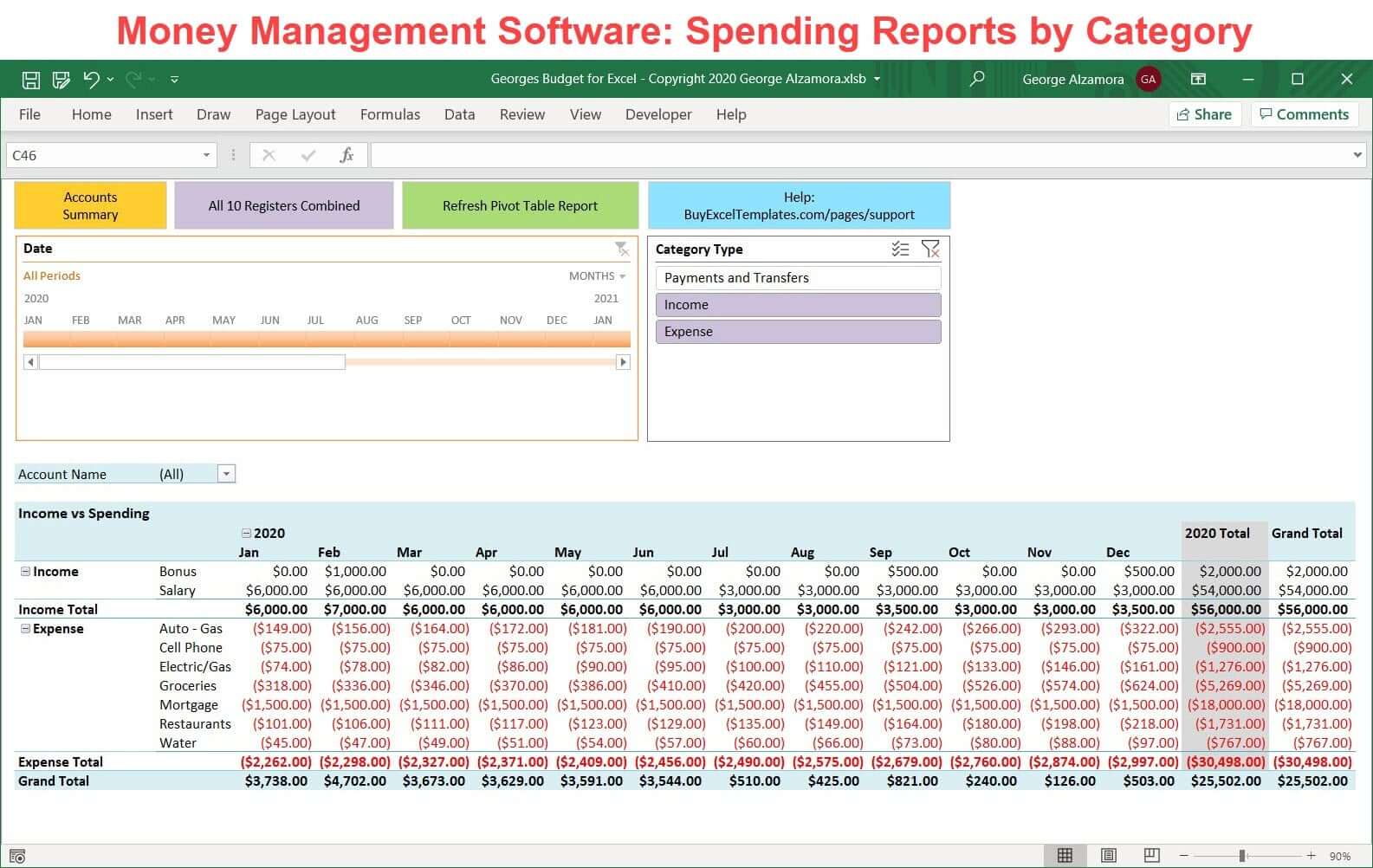

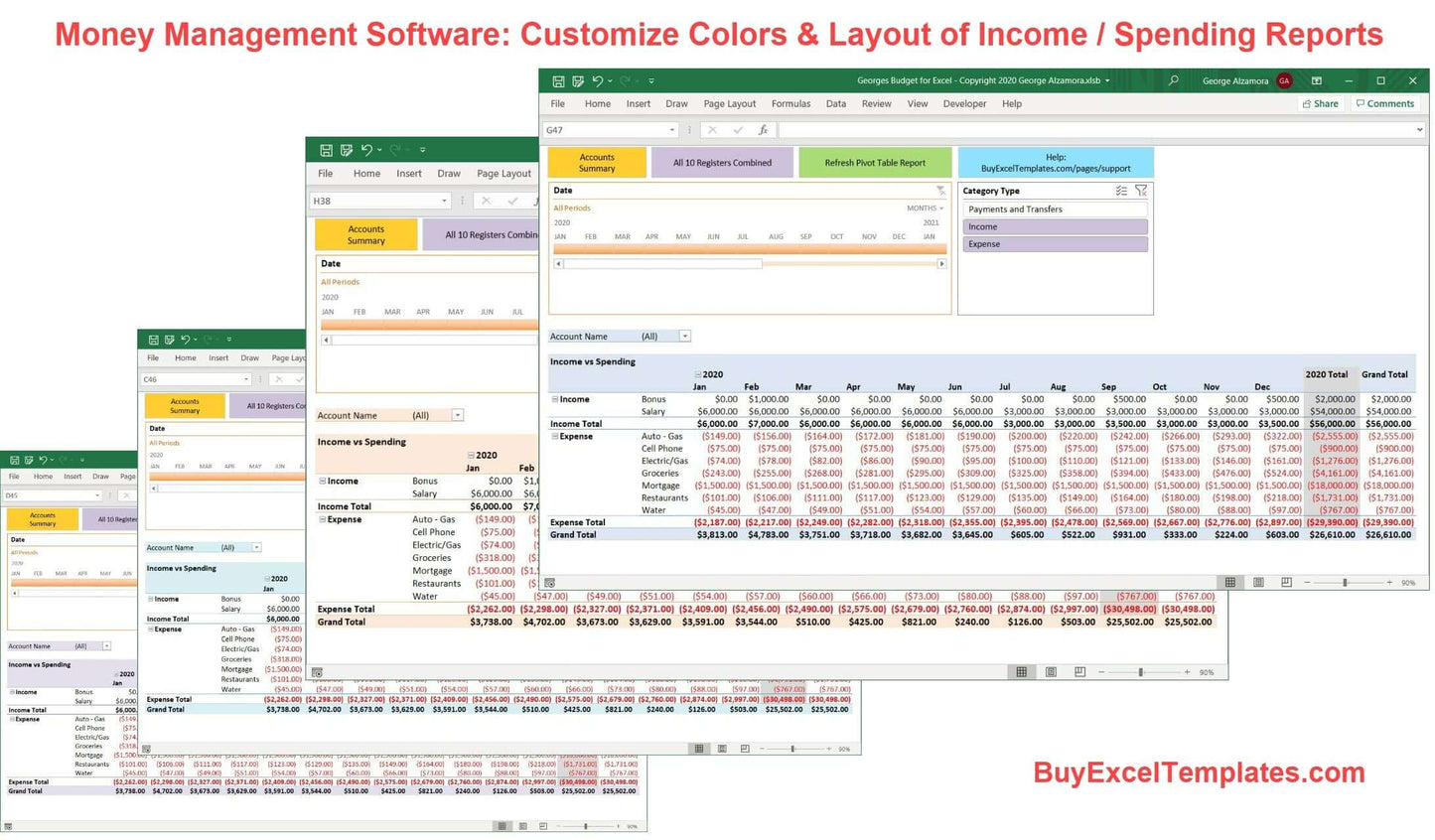

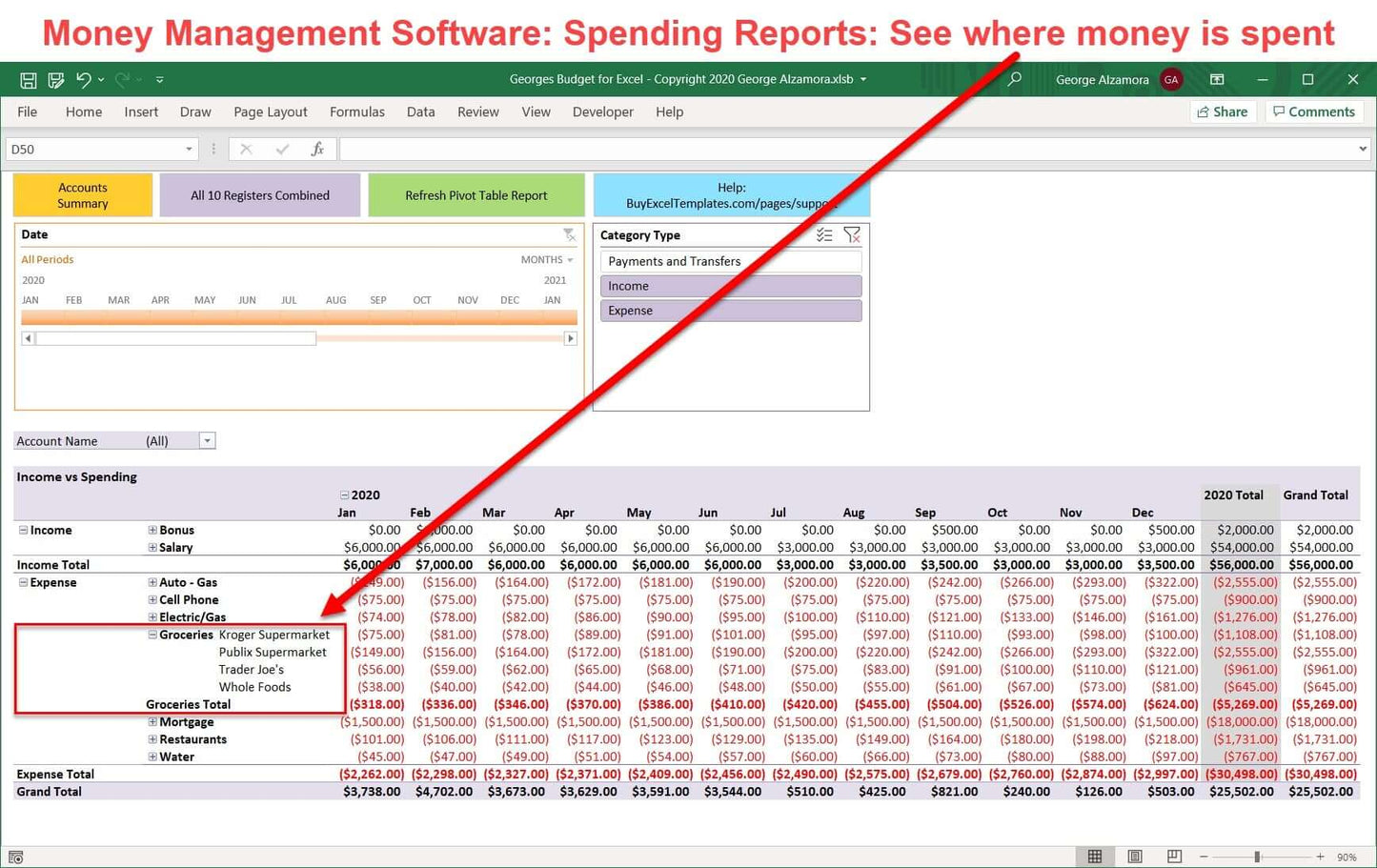

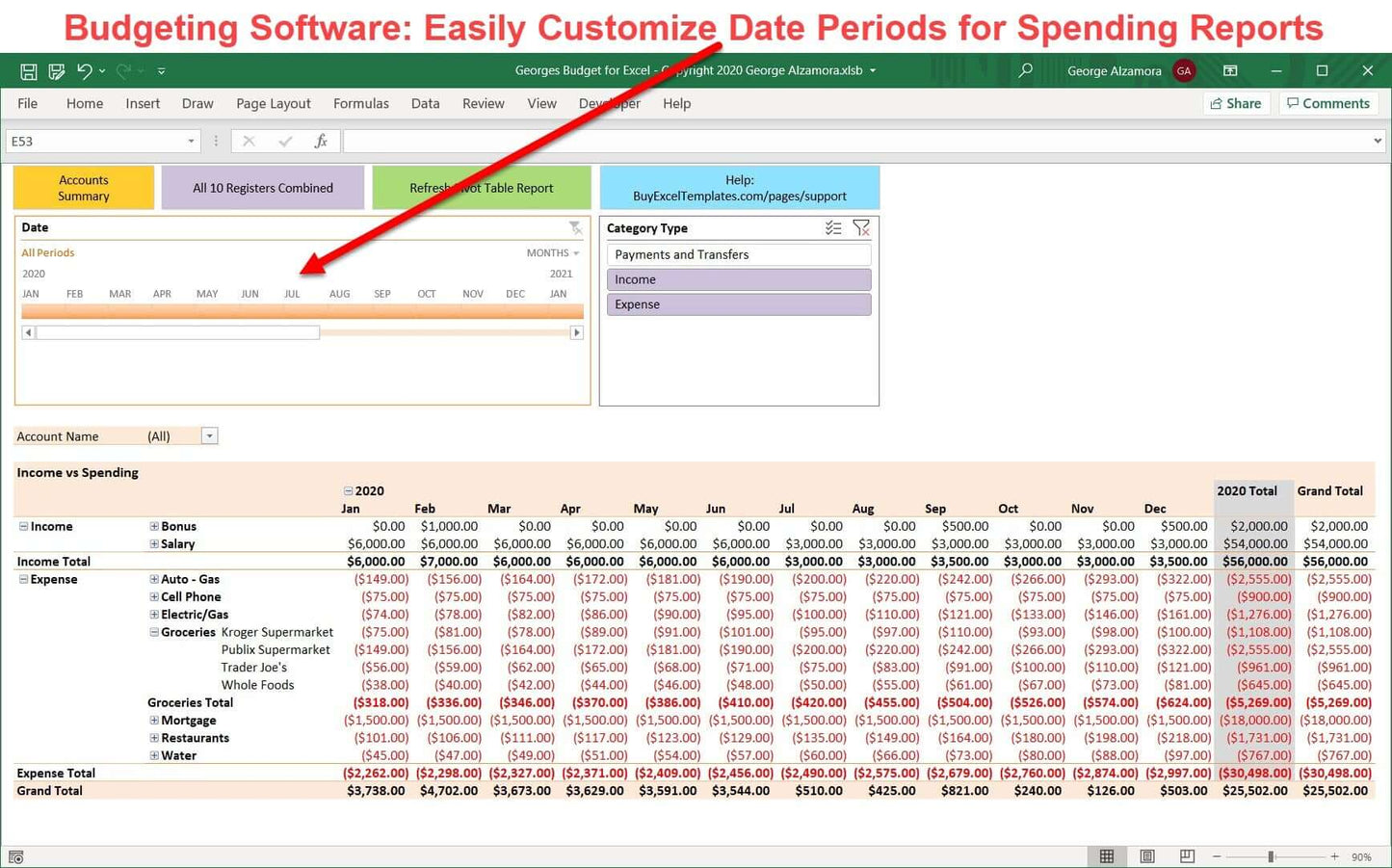

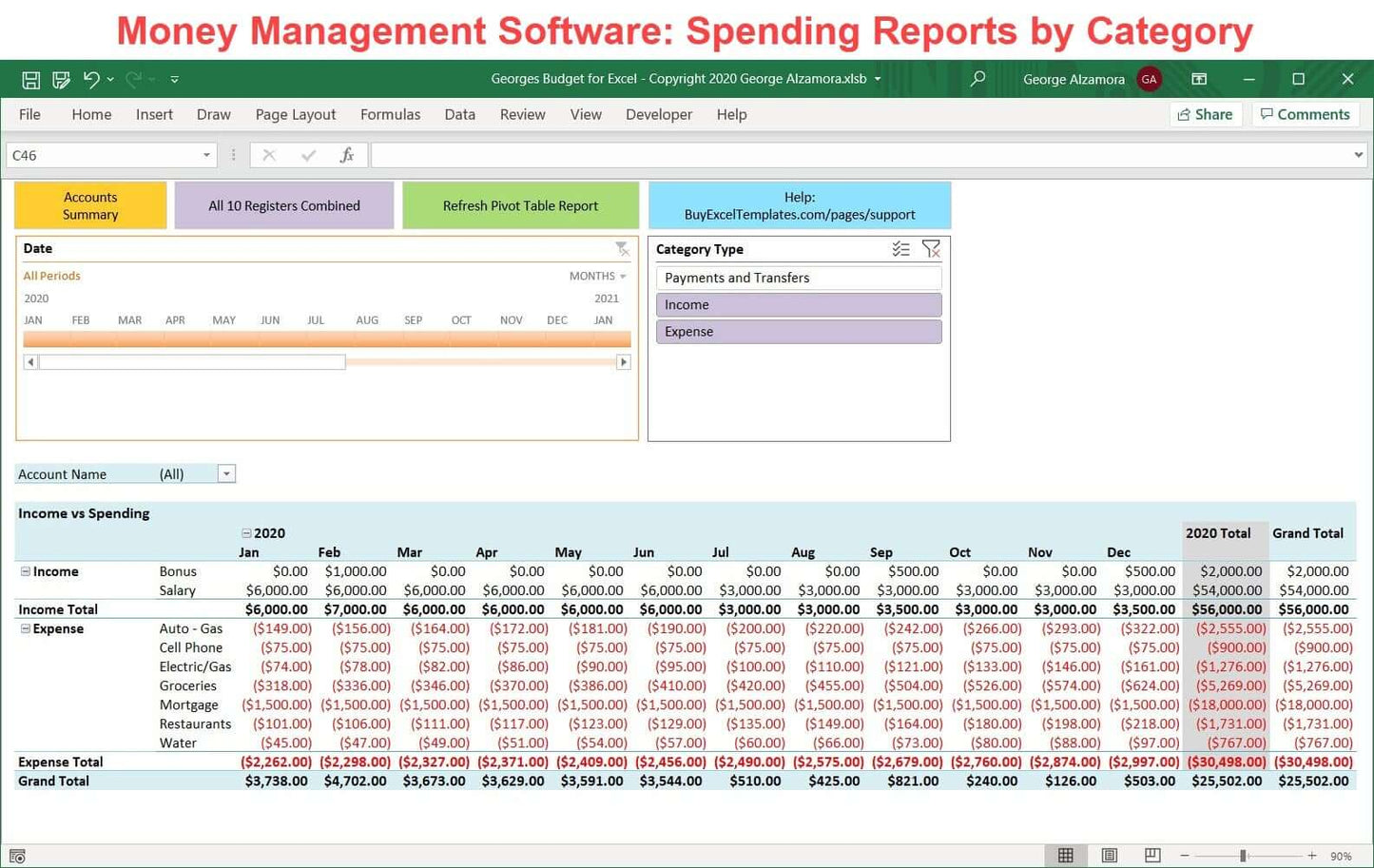

- New customizable reports (such as monthly income vs spending reports and many more reports that you can create such as weekly expense reports and biweekly spending reports based on the categories and descriptions assigned to a transaction). These custom reports allow you to tailor to home budgeting software to your particular financial situation and involve you in the creation process thus making budgeting fun. One of the great new features is that these custom reports can be filtered based on accounts, so your reports can be based on one account, specific accounts, or all financial accounts.

- New Category List worksheet to add, edit, or delete your own categories and the related dropdown list in the registers to easily and quickly add a category to a transaction allows you to have 200 expenses categories and 50 income categories. This is a big improvement from the prior version with has max of 15 income categories and 80 expense categories.

These great money management software features are based in part on direct customer feedback and customer reviews on how to improve the personal finance Excel template with the goal of making it the best money management software using a home budget spreadsheet to budget your money in Excel, cut expenses, save money, pay off debt and pay off credit cards, and build wealth. Top selling money management software that is fun to use.

Whether you are managing your family finances or household finances using joint accounts (whether joint bank accounts, joint checking accounts) or individual separate bank accounts, the money management checkbook software is a great way to keep your finances in order, save money, pay down debt, and grow your net worth.

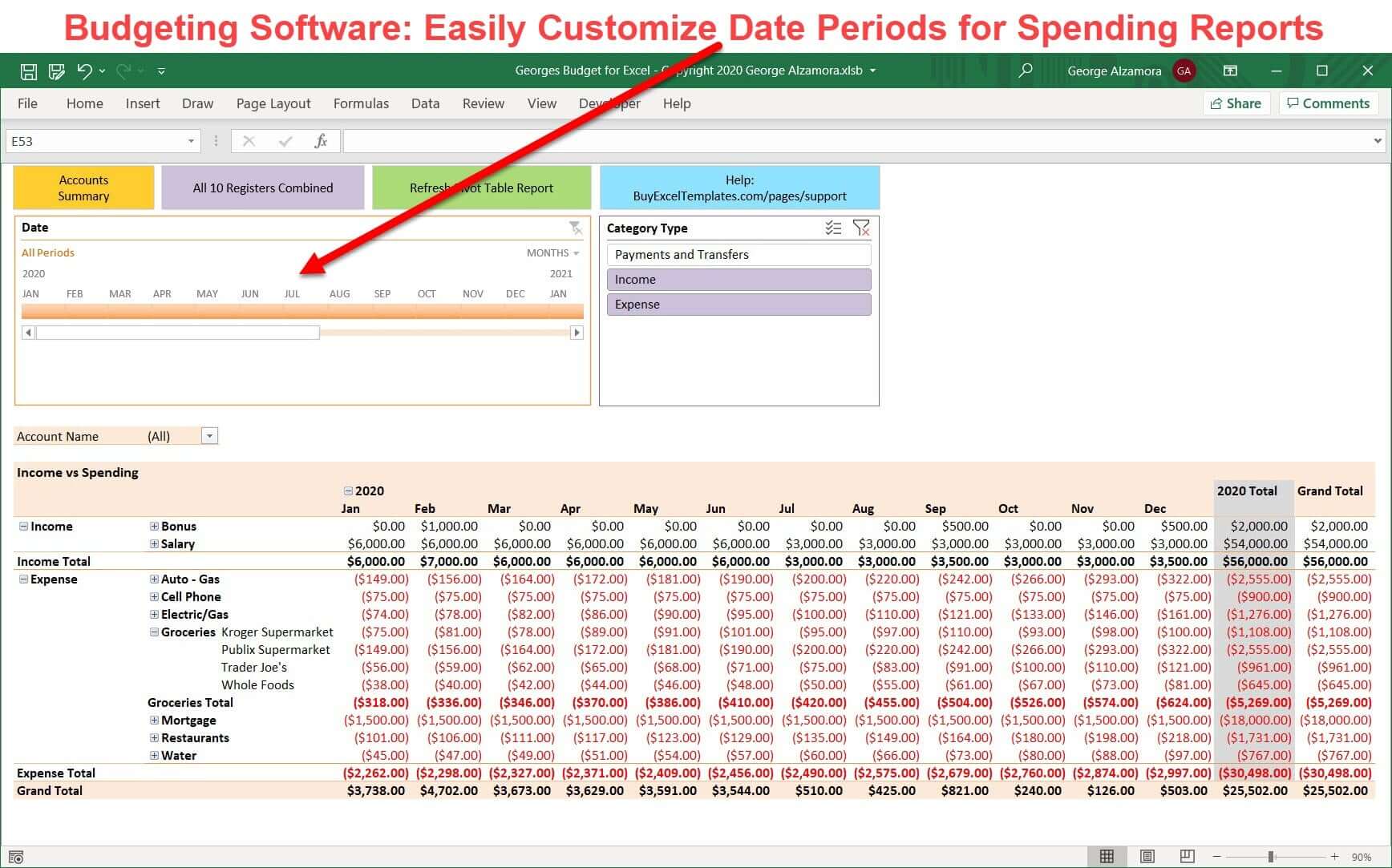

While the budgeting feature is set up for monthly budgeting, you can create custom pivot table reports of actual income and actual spending categories to produce daily reports, weekly reports, biweekly reports, quarterly reports, and yearly reports depending on how you get paid if you want to track your spending based on when you get paid (paycheck to paycheck reports). So if you get paid every two weeks, you can set up a biweekly report in the custom pivot table report to compare your actual income (salary, bonus, etc. ) that you earned in those two weeks vs your actual spending in those two weeks to make sure that you are not spending more than you made in your two week paycheck period.

The money management spreadsheet has monthly actual vs budget, calendar year actual vs budget and also the custom actual reports that include the ability to select custom time periods such as quarterly, specific consecutive months such as (Feb 2023 through April 2023), and non calendar year fiscal years such as Sept 2023 through Aug 2024. You just use the pivot table timeline to select time period range that you want and the pivot table reports are refreshed with the new data. Another report example that you can create with the money management software spreadsheet is having a calendar year report broken down in 1st quarter, 2nd quarter, 3rd quarter, and 4th quarter data, with subtotals for each quarterly period and a grand total for the full calendar year.

In the money management spreadsheet, using the custom Pivot Table reports, you can group categories and get subtotals of those grouping, thus creating a category and subcategory structure. For example, if you create a Pivot Table report and have the category expenses of car loan payment, car insurance, and car gas, you can group those 3 categories into a single main category called Auto Expenses and the pivot table report would produce a grand total for the main grouped category of Auto Expense and separate subtotals for car loan, car insurance and car gas. The Pivot table reports only apply to actual income and actual expenses and not budgeted amounts.

Whether you are looking for 2023 budgeting software, 2024 budgeting software, 2023 budgeting spreadsheet or any year into the future, consider this best selling money management software app. The money management software is great to help you manage your family personal finances with its top selling Excel checkbook spreadsheet with integrated budget spreadsheet. The excel checkbook registers can manage multiple accounts including checking accounts, savings accounts, money market accounts, credit card accounts whether you use a large bank or local credit union. The checkbook spreadsheet and personal budget software can manage your assets (set goals to build your wealth) and liabilities (set goals to get rid of you debt and become debt free).

System Requirements:

- PC (Microsoft Windows computer) with Excel for Microsoft 365 (previously named Excel for Office 365). (part of Office 365 subscription / Microsoft 365 subscription) or Microsoft Excel 2021 / Excel 2024

- Mac Computer with Excel for Microsoft 365 for Mac (Excel for Office 365 for Mac) (part of Office 365 subscription / Microsoft 365 subscription) or Microsoft Excel 2021 for Mac / Excel 2024 for Mac. You need to have one of these specific versions of Microsoft Excel for Mac. Not compatible with Apple iphone or Apple iPAD.

- PC and Mac should have minimum 4 GHz processor, 8 GB RAM and SSD storage. The home budgeting spreadsheet (Georges Budget for Excel v14) may work if personal computer or Mac computer has less than these system requirements but it will be slower due to large amount of Excel formulas and the Excel template may not work.

- The money management software is supported in the United States, Canada, and Australia as amounts are formatted with the $ symbol and Dates are formatted as MM/DD/YYYY.

- The Excel template is not compatible with Google Sheets (Google Spreadsheets)

- The Excel budget template is not compatible with Apple Numbers spreadsheets

- The home budgeting spreadsheet is not compatible with Microsoft's free "Excel Online" app that is part of the free Office Online apps. These online apps are web browser based and have limited features compared to the full desktop version of Microsoft Excel.

- The Excel budget template is not compatible with the Excel Mobile app whether using Android or iphone. (Excel mobile app is part of Microsoft Office Mobile apps that allow you to use a feature reduced version of Excel on your compatible mobile phone and smaller tablet devices to review, update, and create spreadsheets). The Excel template requires one of the full desktop versions of Excel listed above in the system requirements.

- Whether you are using a PC with Windows 11, Windows 10 or a Mac computer with the latest Apple macOS operating systems, the key is to make sure your operating is compatible with one of the listed compatible versions of Microsoft Excel and that your computer meets the hardware specs whether you are using a laptop computer or desktop computer.

- Make sure to install the 64 bit version of the operating system (Windows 10, Windows 11, or macOS) you are using on your computer or laptop and the 64 bit version of Microsoft Excel that you are using.

License Terms and Refund Policy:

By purchasing you agree with the License Terms / Terms of Sale.

By purchasing you agree with the refund policy.

Excel is a registered trademark of Microsoft Corporation.

Video: Money Management Software

Great Excel software for maintaining budgeting entries. Better than Quicken, that I used for years, until they started subscription service. I can even reconcile my entries with bank statements.

Hi Ron,

Thank you for the 5 star review. Great to hear that the Money Management Spreadsheet is helping you with your personal finances.

George

I looked all over to find the right Excel template. I’m so glad I found Georges Budget for Excel v14. It's perfect! Being a novice at Excel, I could never have created what I need to track the costs on my home renovation projects. This template does everything I need and more!

George was able to take an excellent product and make it better. All the new features are spot on! Reports keep getting better and better. I was already a fan, and now a bigger fan. This product is maturing and growing nicely. Keep it up, George!

THIS SREADSHEET IS AMAZING! I HAVE USED USED QB FOR 20 YEARS PLUS.I MARVEL AT THE THINKING MUST HAVE GONE INTO IT. I HAVE SEEN SOME COMPLAINTS THAT SOME CELLS ARE LOCKED. THAT IS WONDERFUL, IT IS A BLESSING IN DISGUISE!!!! IT PROTECTS ME FROM OVER THINKING THINGS AT 2 OR 3 IN THE MORNING AND MAKING A MESS OF MY ACCOUNTING. A MESS THAT COMPLICATES EVERYTHING DOWN THE ROAD CREATING CONFUSION AND TAKING TIME TO CORRECT. GEORGE RESPONDS TO QUESTIONS QUICKLY AND IN CLEAR LANGAUGE. THE FAQ USUALLY HAS THE ANSWERS I NEED.HIS VIDEOS ARE DONE SO WELL. AS I WATCH THEM I HAVE WONDERED IF GEORGE IS A PROFESSOR OR A TEACHER.HE JUST VERY PRECISELY LAYS IT ALL OUT AND EXPLAINS THINGS MORE THAN JUST ONCE. YESTERDAY I WAS THINKING OF PLACING AN OBIT FOR CUSTOMER SERVICE LOL .NOT SO WITH GEORGE. THE PROGRAM THAT I HAVE USED FOR 20 YEARS+ COSTS $300.00 A YEAR AND THEIR CUSTOMER SERVICE IS TERRIBLE. THEY LOST MY DATA AND IT TOOK 6 WEEKS FOR MY REQUEST TO HAVE A SUPERVISOR CALL ME. THIS IS A VERY HELPFUL TOOL AS A CHECKBOOK AND A BUDGETING FRIEND. I WOULD RECOMMEND IT TO ANYONE.

Love the new pivots to see the line by line transactions on a monthly, quarterly, half -year or yearly basis.

Also like the new combined accounts.

Love the ability for additional categories.