Personal Finance Software | Georges Budget for Excel v17

Personal Finance Software | Georges Budget for Excel v17

Couldn't load pickup availability

- Extra 10% off with code SHOPSAVE10

- 10,000+ customers

- Spreadsheet Created by Owner

- One-Time Purchase: No Subscription

- Instant Download

- Fast Support: Based in USA

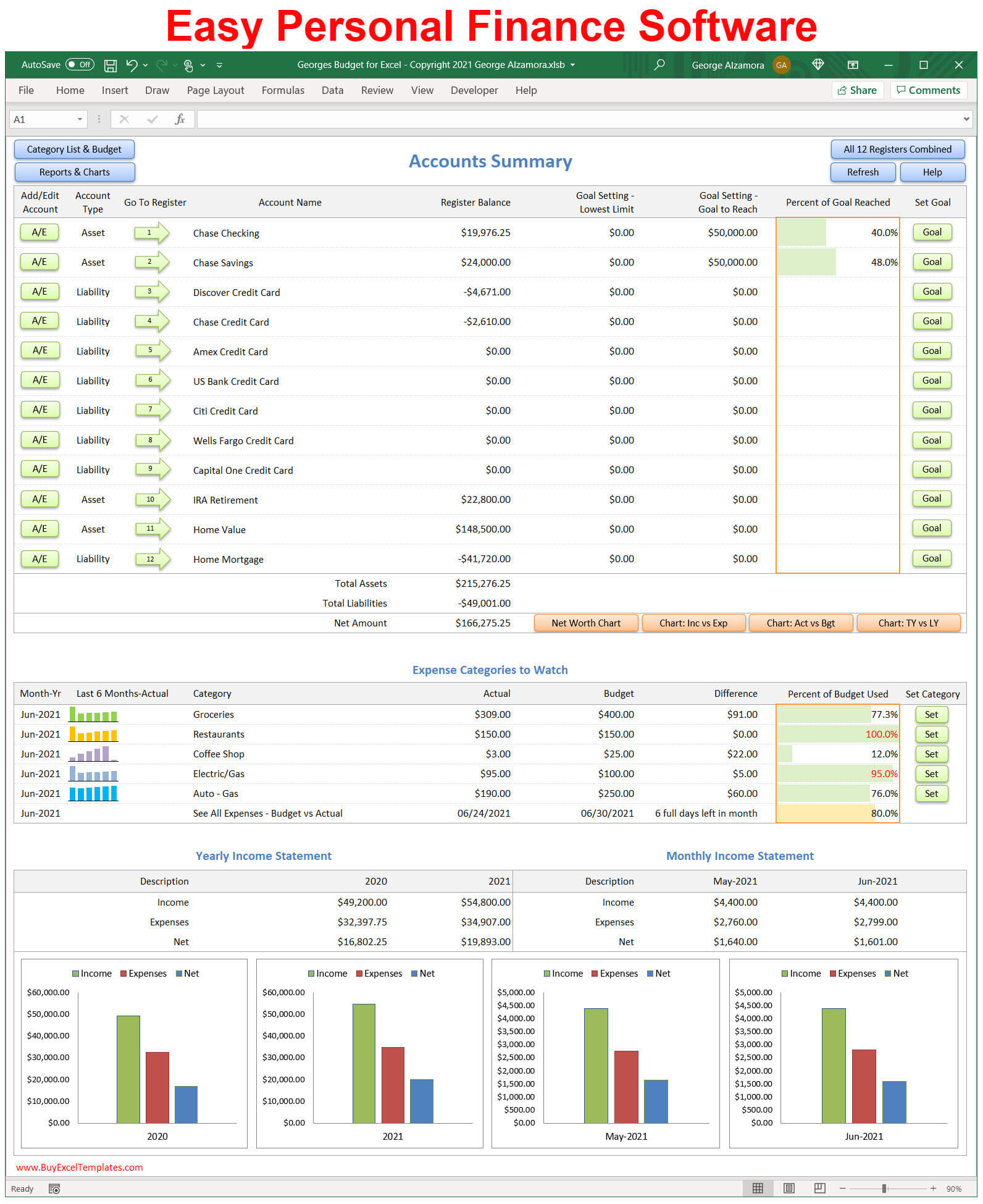

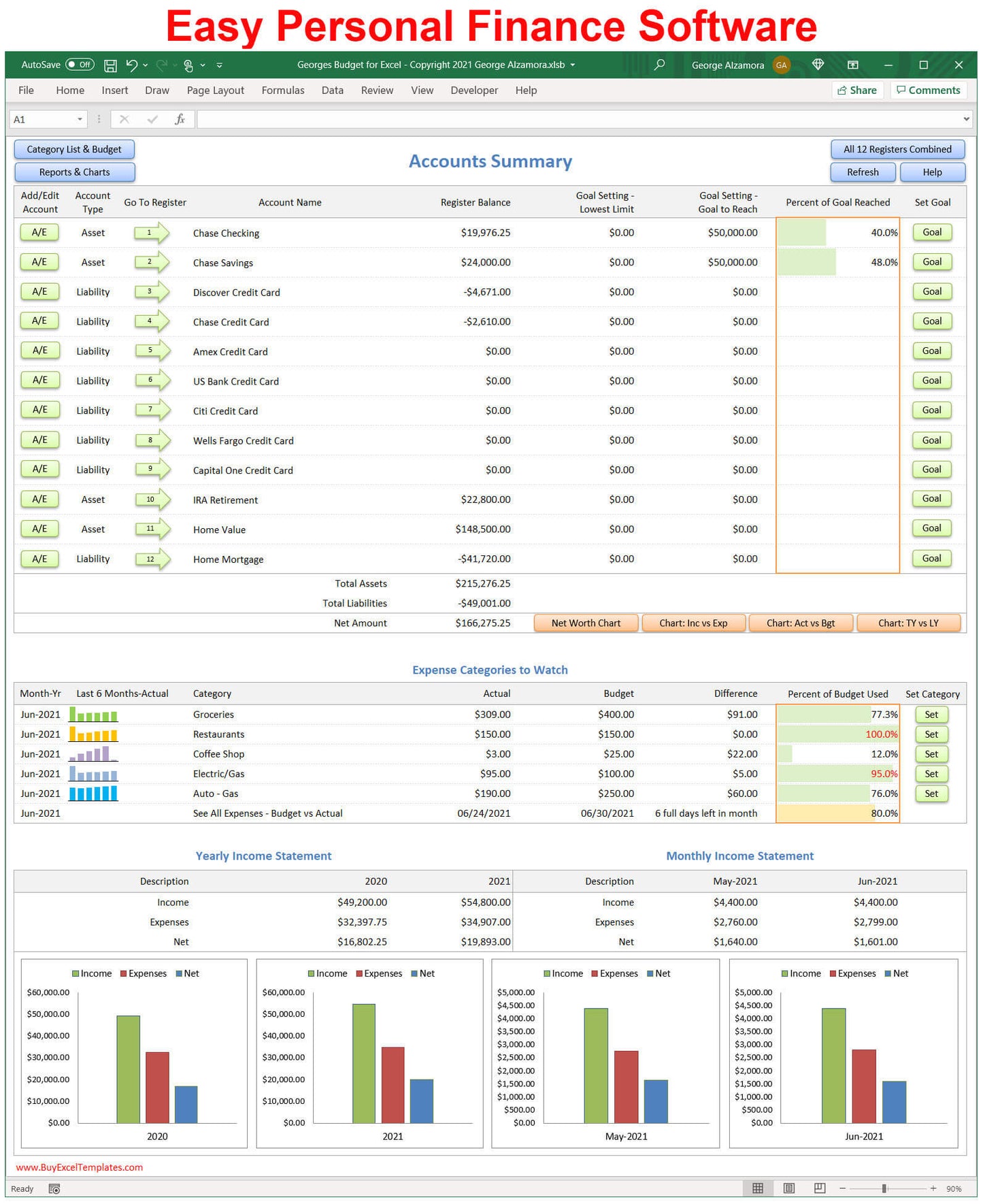

Simple budgeting with integrated checkbook software to help you stay on top of your personal finances.

Top features in Georges Budget for Excel v17: (watch video  below for overview)

below for overview)

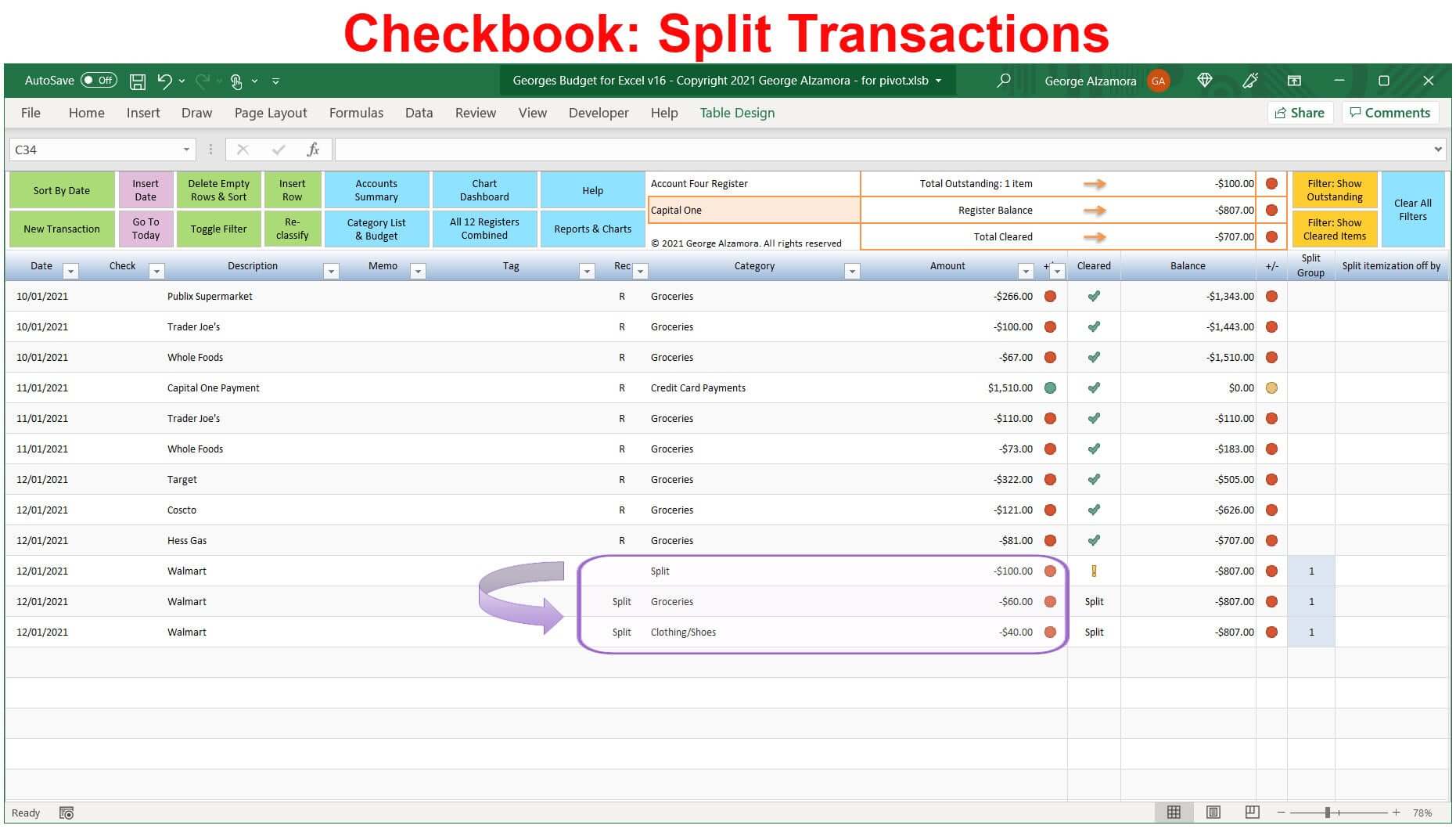

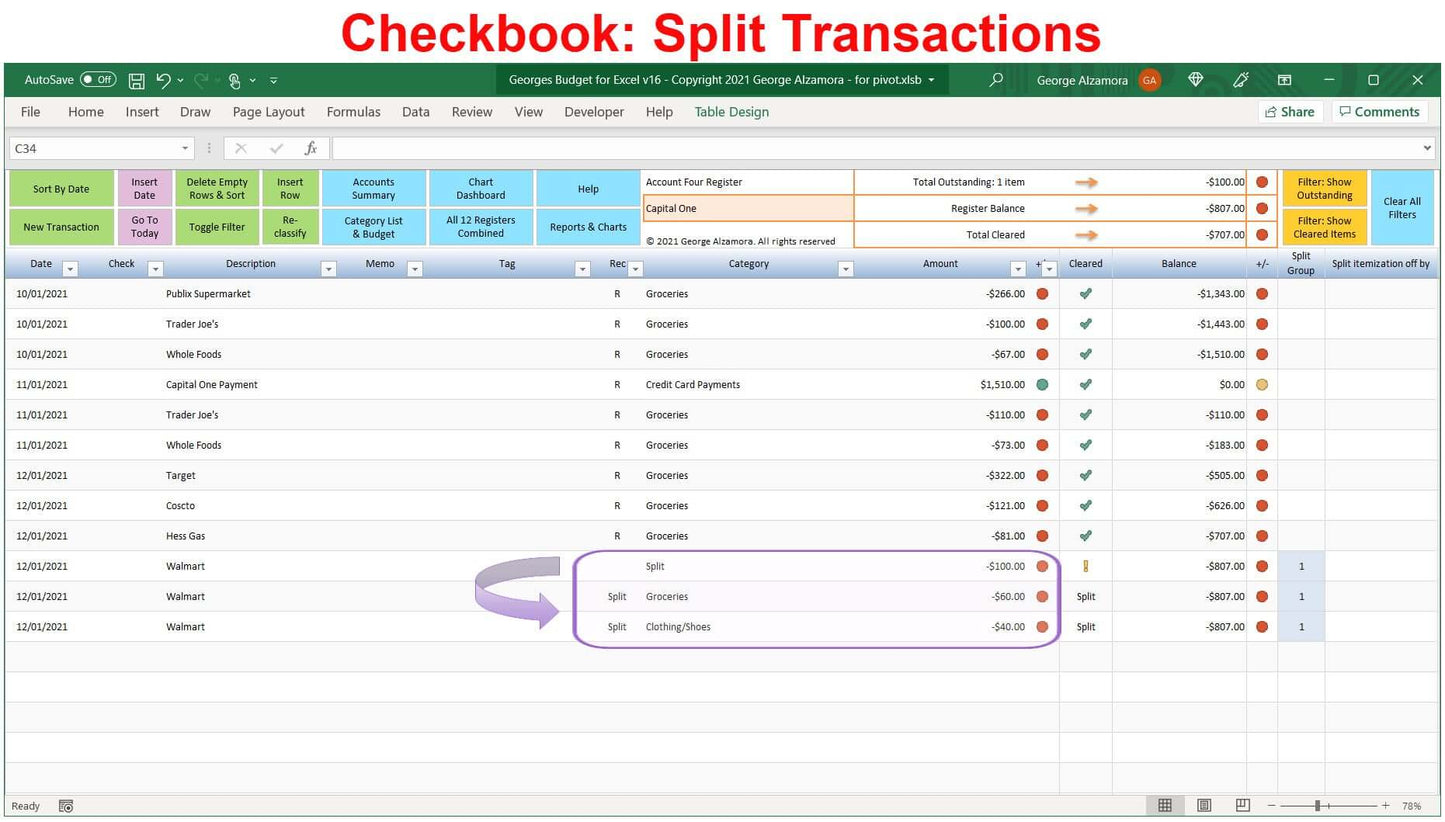

- Simple checkbook software with ability to split transactions

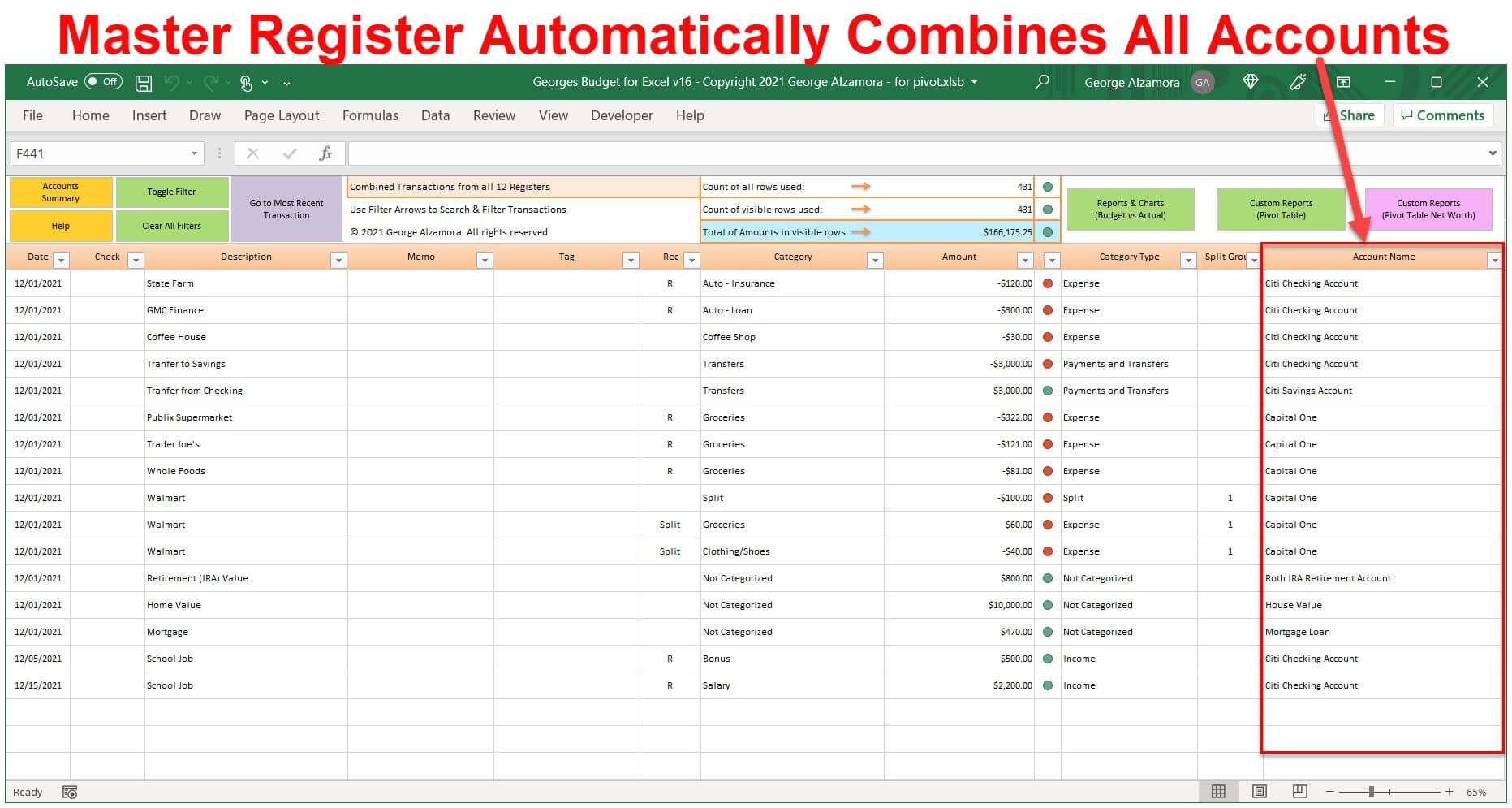

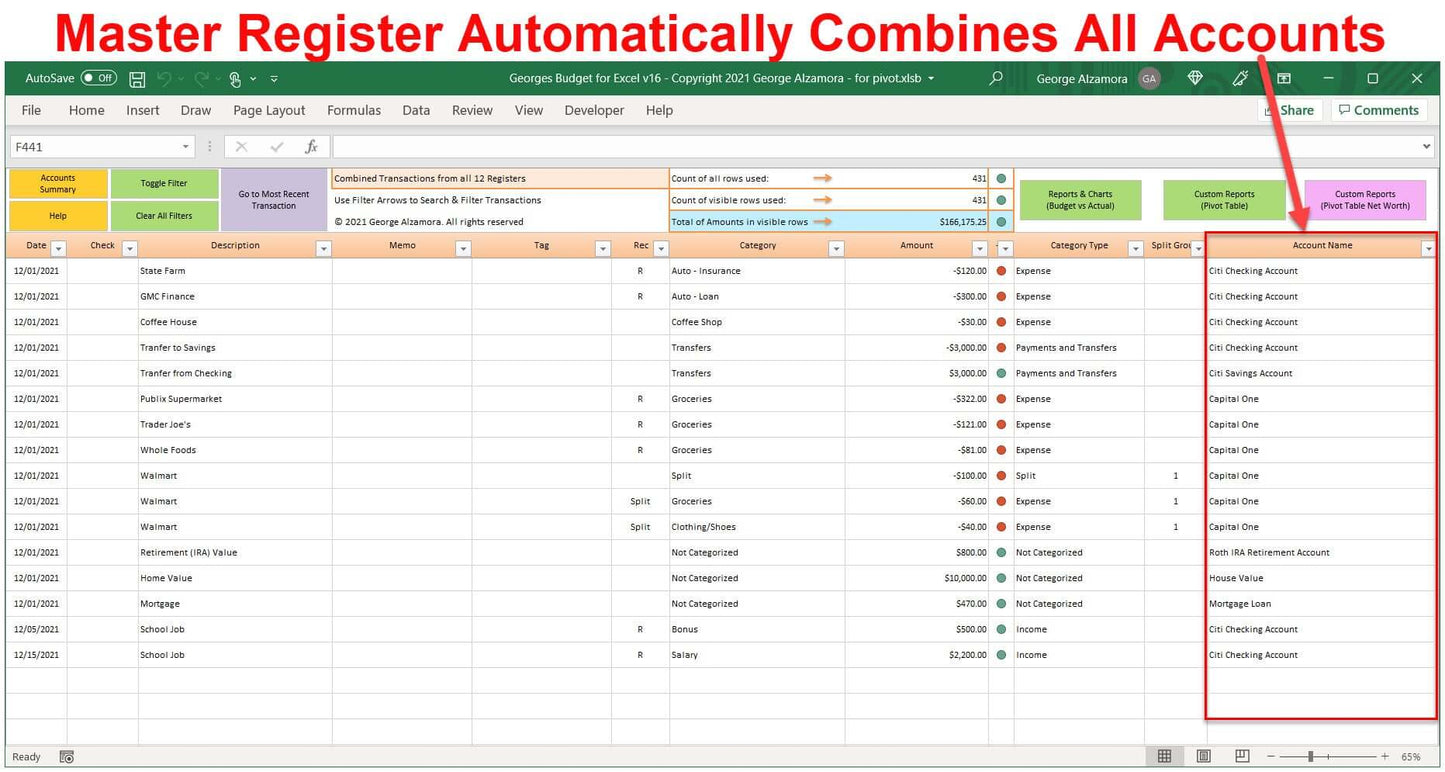

- Master consolidated transactions register of all accounts

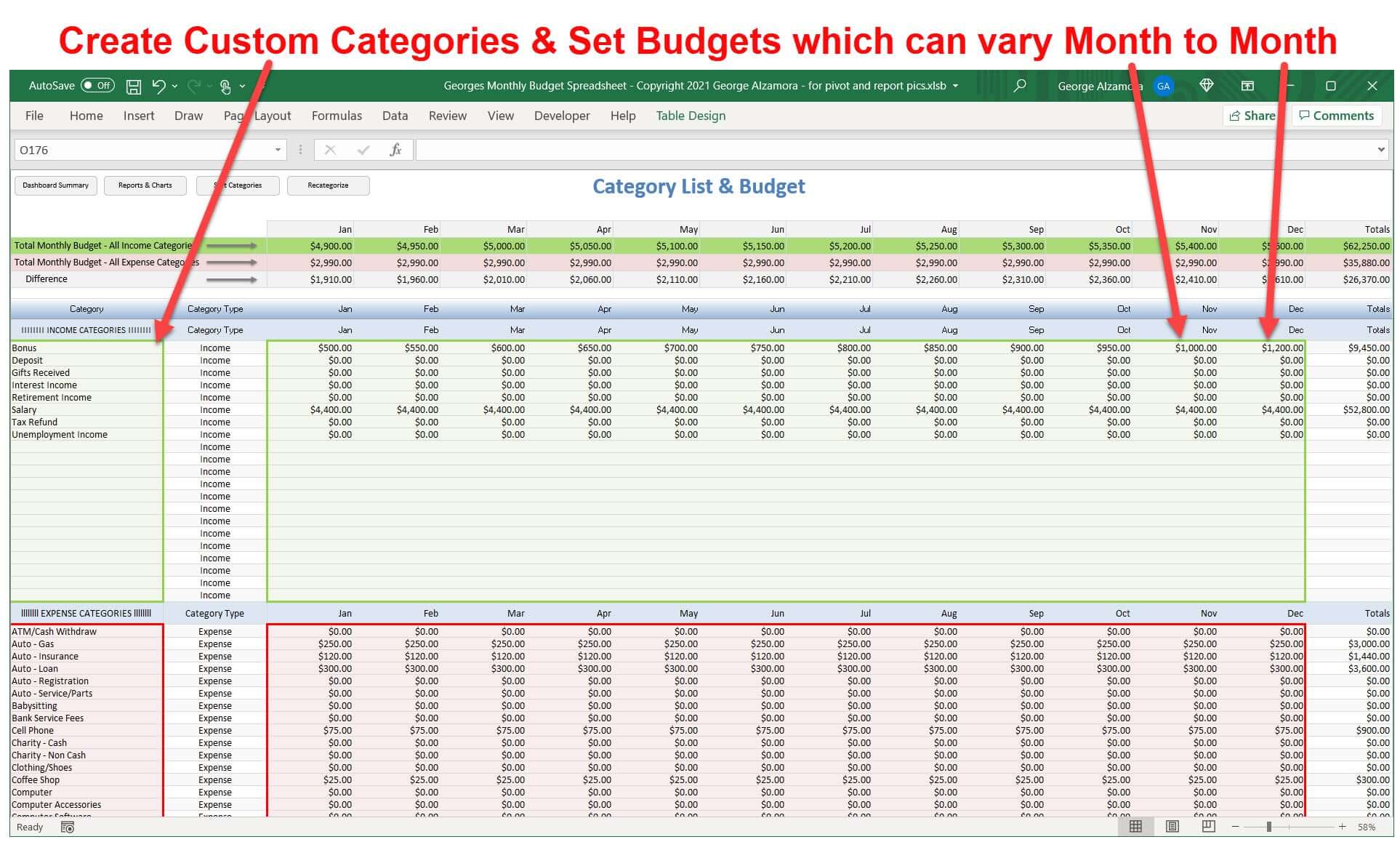

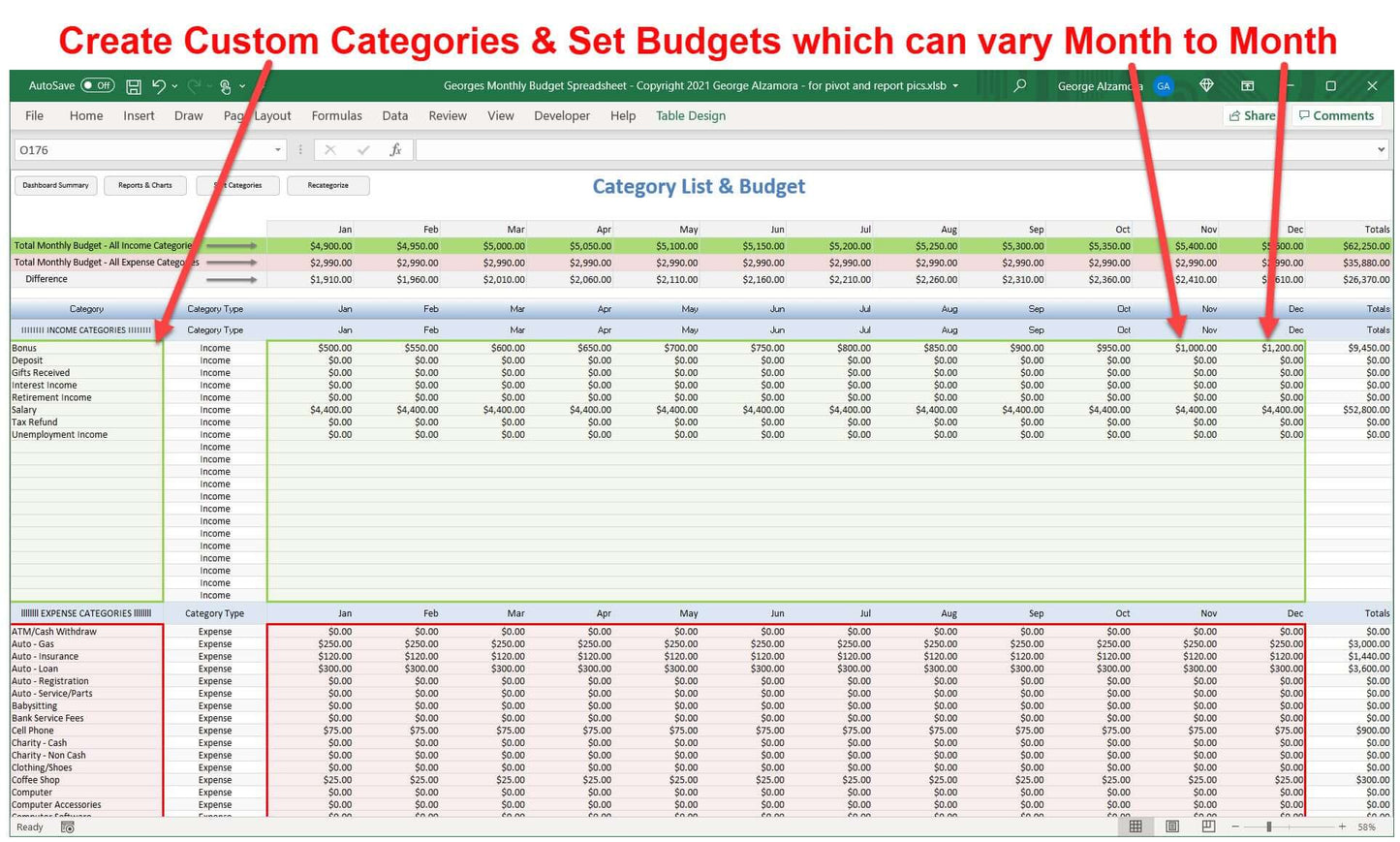

- Integrated budgeting

- Amazing reports and Excel charts to help you stay on budget and save money and help offset rising prices due to inflation.

- One time purchase (no subscriptions required). Great way to start saving money with budget software.

New features in Georges Budget for Excel v17:

Summary: New Excel Chart Dashboards and Reports to help you quickly see your financial situation and make adjustments if needed to help improve your finances. Includes feature requests from loyal customers of our Excel spreadsheets.

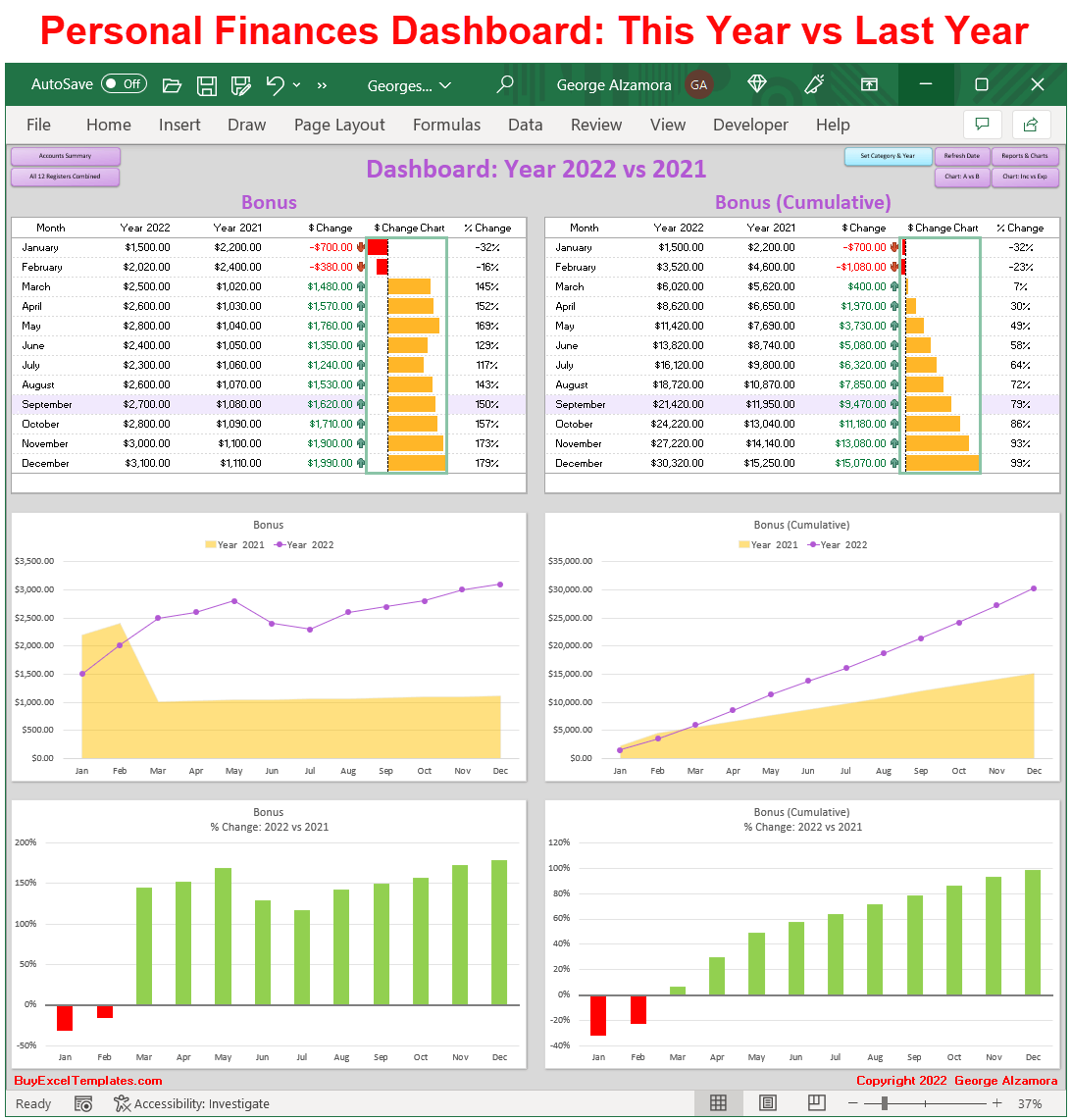

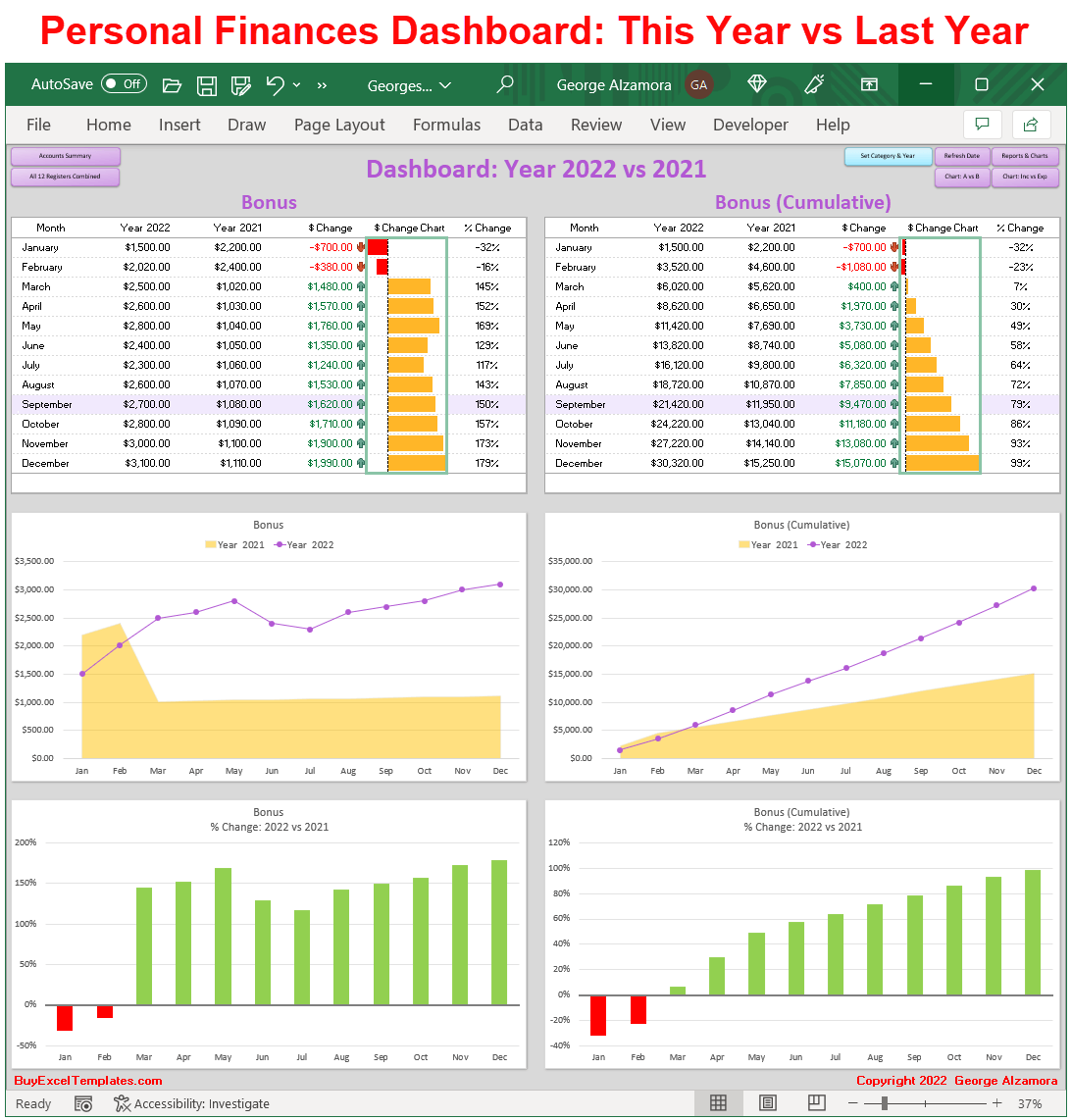

New Feature #1: New Year over Year Comparison Chart Dashboard on a single worksheet automatically generated to help you manage your finances. The dashboard includes:

Time Comparison Periods:

- This Year vs Last Year

- Last Year vs 2 Years Ago

Within the selected time period, you can select to compare:

- Any single Category (such as: 2022 Salary vs 2021 Salary)

- Total Income (ex. 2022 Total Income vs 2021 Total Income)

- Total Expenses (ex. 2022 Total Expenses vs 2021 Total Expenses)

- Net Amount (ex. 2022 Net Amount vs 2021 Net Amount)

The Excel Charts and Tables include the following comparisons:

- Actual amounts comparison between time periods (monthly and yearly) (including cumulative amounts)

- $ Differences between time periods (monthly and yearly) (including cumulative amounts)

- % Differences between time periods (monthly and yearly) (including cumulative amounts)

For example, you could compare your Total Income This Year vs Total Income Last Year with month to month and yearly totals and see the $ and % differences between the two time periods.

The Table Reports include green/red up down arrows to highlight positive or negative net amounts. The Cumulative Charts and Table running totals start at the beginning of each calendar year. The current year data is highlighted in Excel table to easily focus on current period in the Excel template.

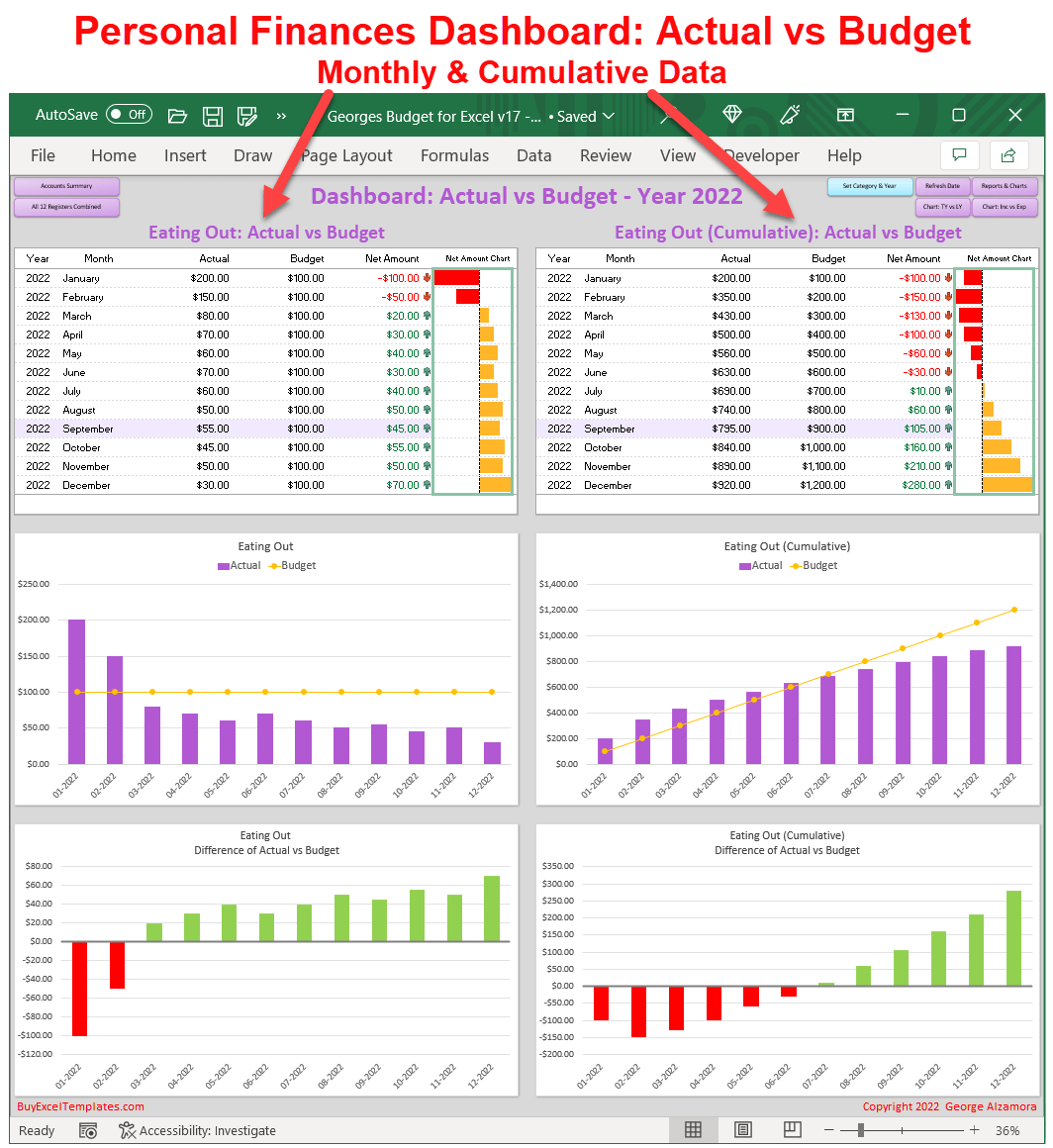

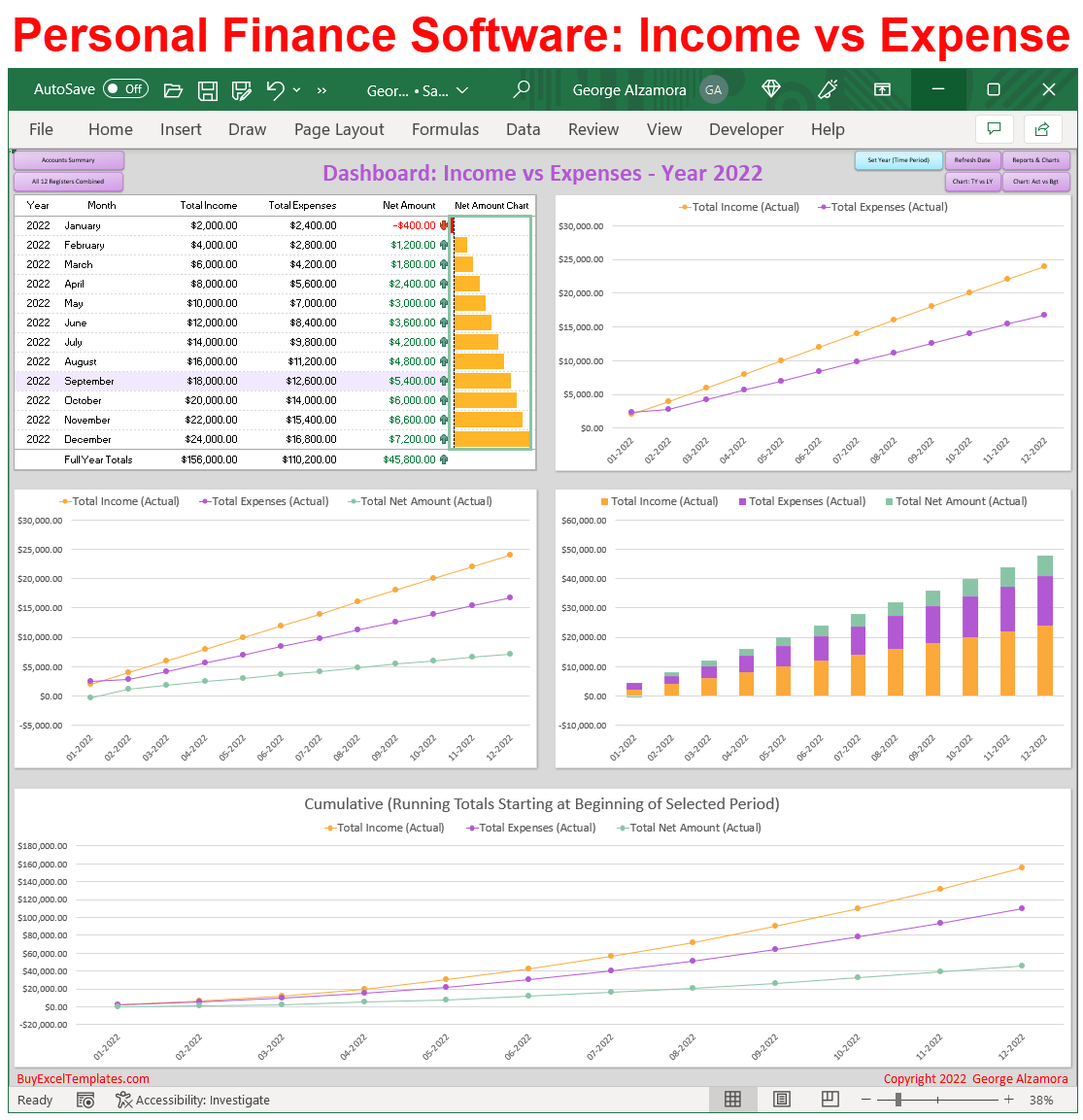

New Feature #2: New Actual vs Budget Chart Dashboard on a single worksheet automatically generated to help you manage your finances. The dashboard includes:

Time Comparison Periods include:

- This Year

- Last Year

- Last 12 Month

Within the selected time period, you can select to compare:

- Any single Category (such as: Groceries: Actual vs Budget)

- Total Income (Actual Total Income vs Budgeted Total Income)

- Total Expenses (Actual Total Expenses vs Budgeted Total Expenses)

- Net Amount (Actual Net Amount vs Budgeted Net Amount)

The comparison in the Excel Graphs and Tables include:

- Actual vs Budget vs Net amounts comparison (monthly and yearly) (including cumulative amounts)

- $ Differences between Actual and Budget amounts (monthly and yearly) (including cumulative amounts)

The Table Reports include green/red up down arrows to highlight positive or negative net amounts. The Cumulative Chart running totals start at the beginning of the selected time period.

Benefits of the Excel Actual vs Budget Chart Dashboard:

- Cumulative budget and cumulative actual amounts help you stay on budget for the entire calendar year vs just a single month. For example, lets assume the current month is Mar-2022 and you set a budget for "Dining Out" of 100.00 per month. In the "Dining Out" Category, in January you spent 300.00, February you spent 50.00, and in March you spent 10.00. So if you are just looking at the current month of March, you are still under budget by 90.00, but if you look at the number on a cumulative basis starting at the beginning of the year (Jan through Mar), you have overspent on your cumulative budget (Actual 360.00 vs Budget 300.00) and this Excel dashboard template provides these insights to help you improve your personal finances.

- See trends in your data using the charts (ex. my expenses trending up vs my budget)

- Current Month/Year data is highlighted in the table allowing you to quickly scan to the current period information in the Excel spreadsheet.

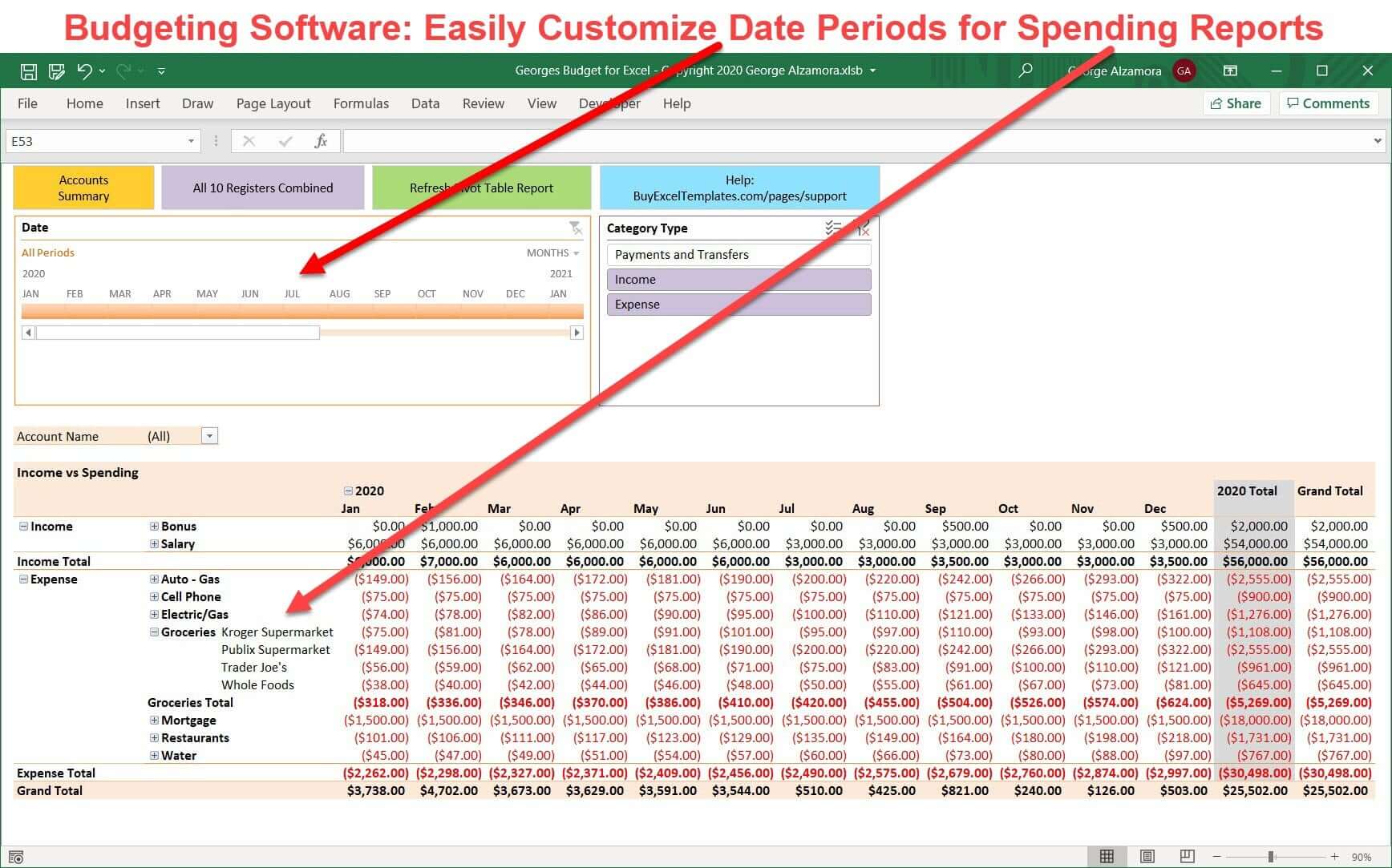

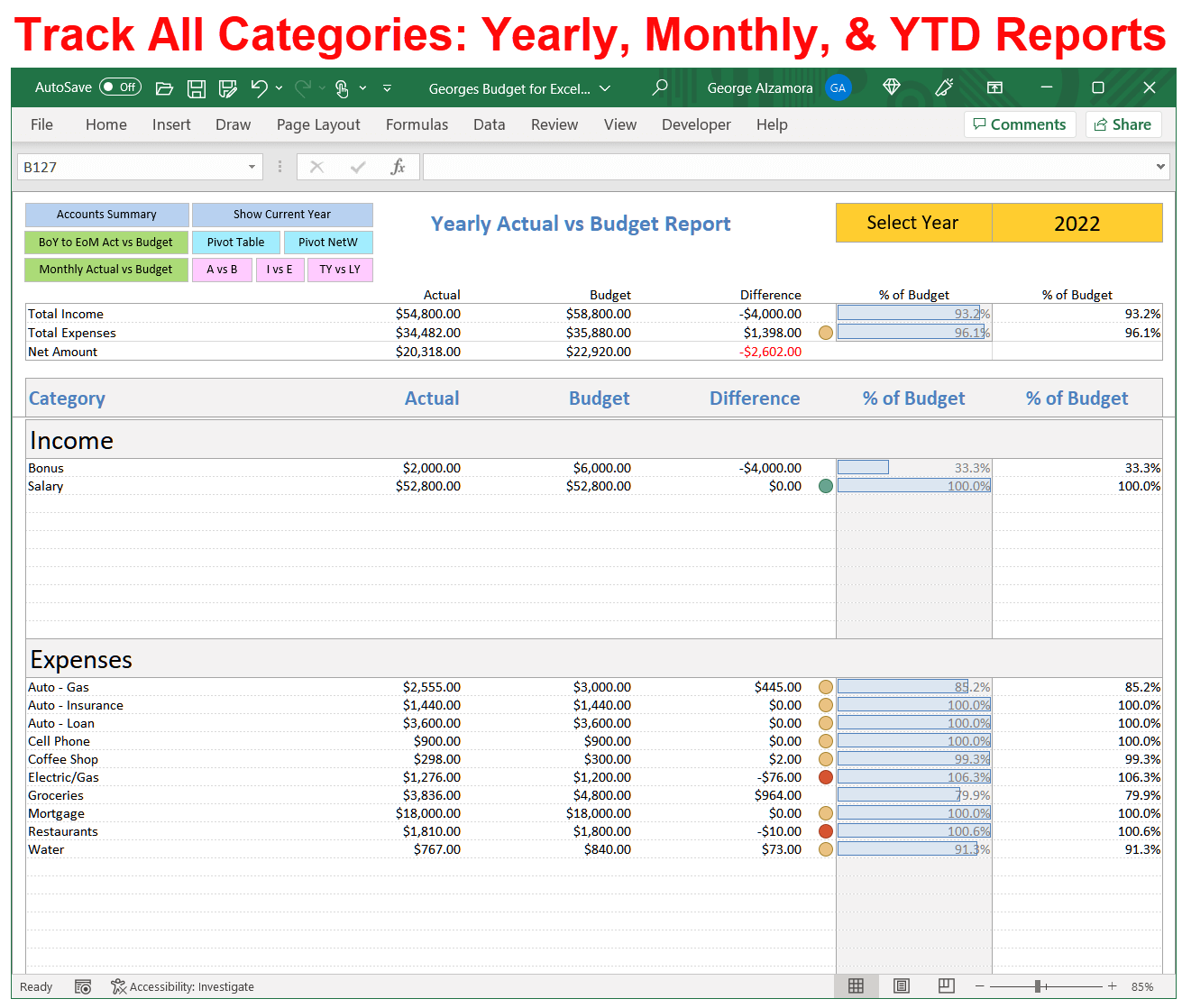

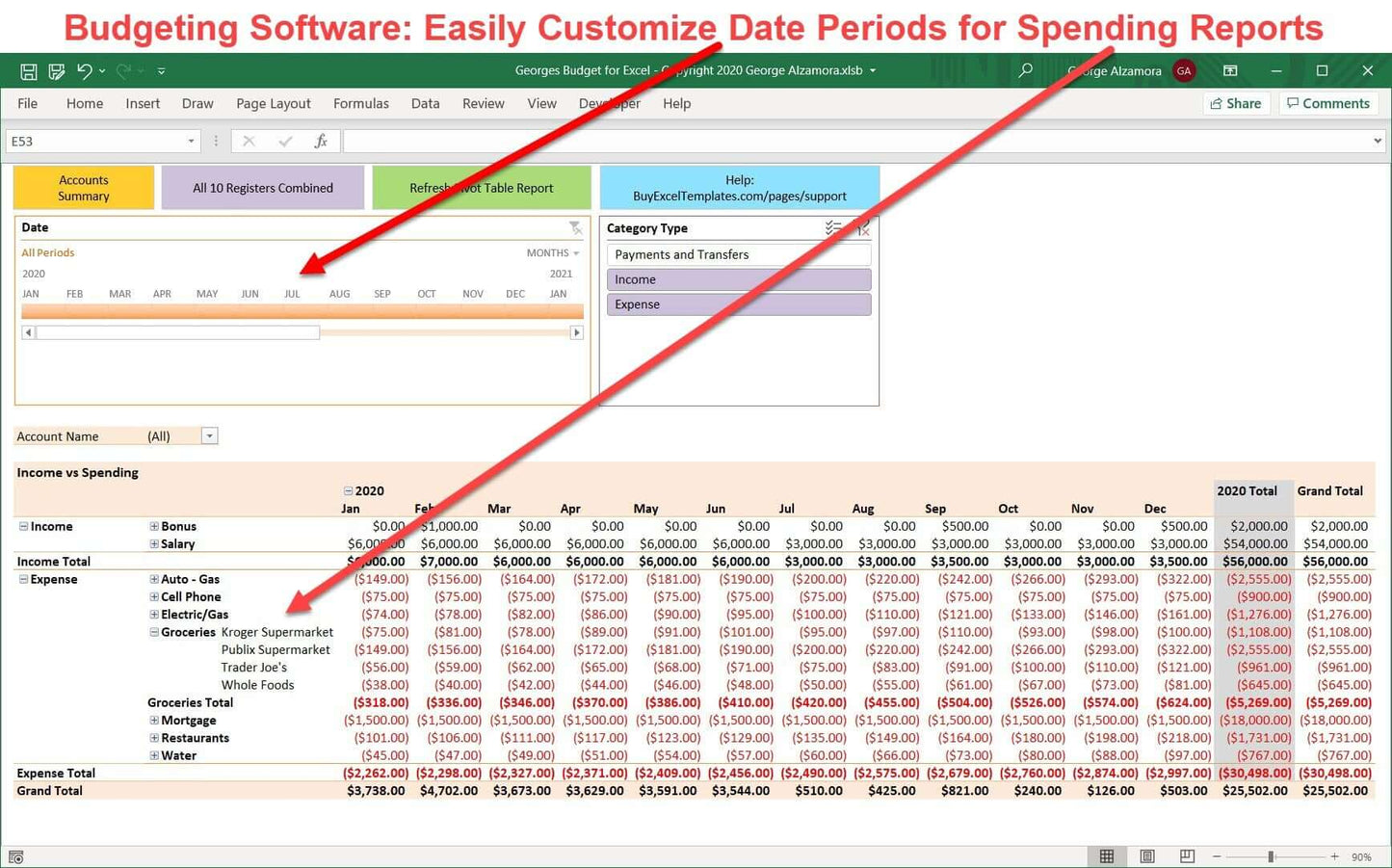

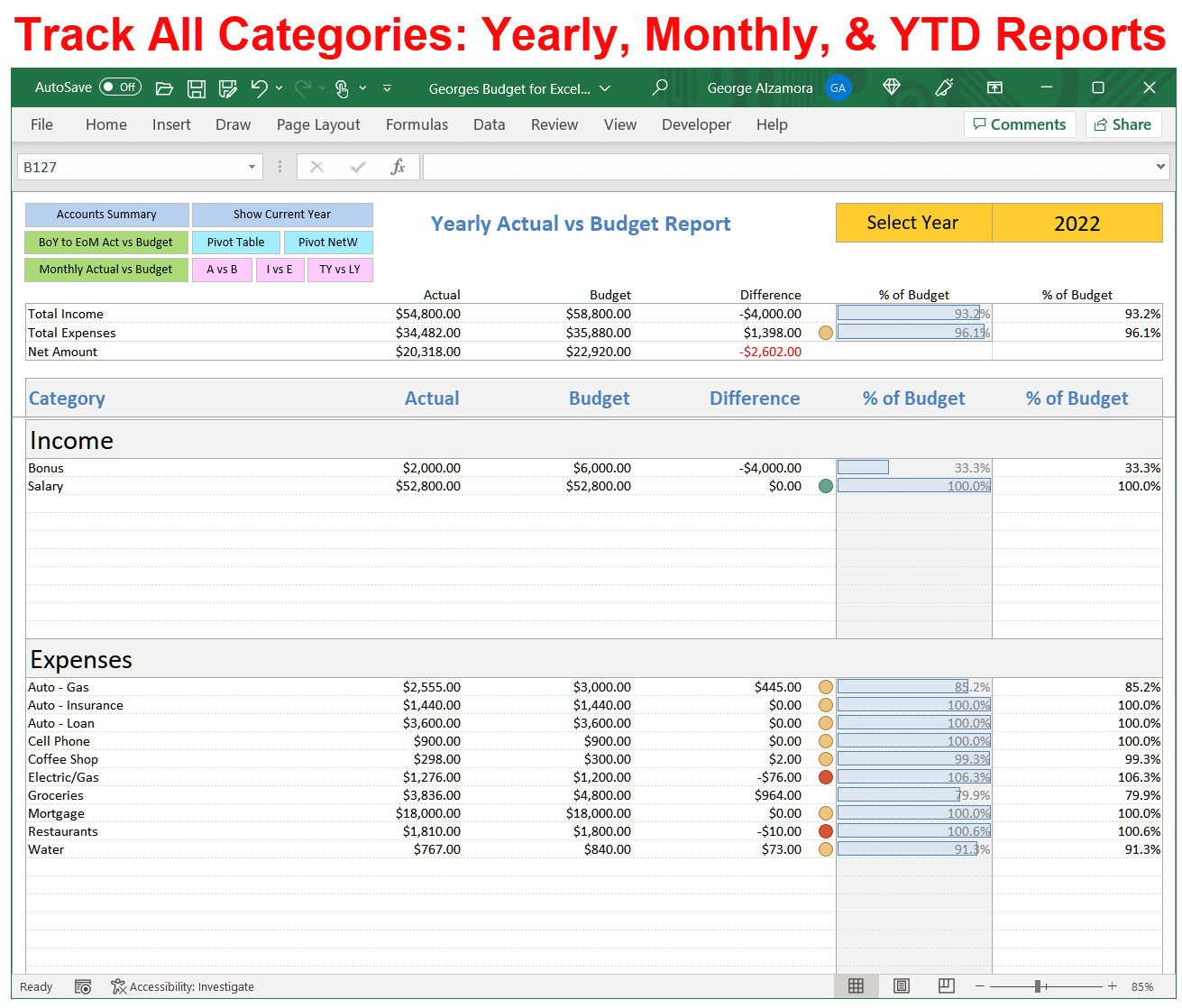

New Feature #3: New Actual vs Budget worksheet for the time period of Beginning of Calendar Year to End of Selected Month.

Select a Month and Year and the report will display Category Actual totals that are a summation of transactions from the beginning of selected Year through the end of the selected Month and compare those to Budget amounts that are of the same time period. The report displays all Category Totals, Total Income, Total Expenses, and Total Net Amount on a single worksheet.

For example, if you selected a report date of Aug-2022, the Reports Actual Category totals would be from transactions dated from Jan-1-2022 through Aug-31-2022. Because the software lets you set a different Category budget amount for each month of the year, the budgeted amounts would be based on the Budget amounts you set for Jan through Aug.

Benefits of the Actual vs Budget Worksheet Template:

- This report displays all Categories on a single worksheet for the given report time period and compares actual amounts to budgeting amounts and includes in cell bar graphs indicating % of budget used / reached and indicator lights so you can get a broad overview on your finances vs focusing in on a single category.

- Improved Actual vs Budget comparison since the time period now include "Year to End of Selected Month" for both the budgeted and actual amounts.

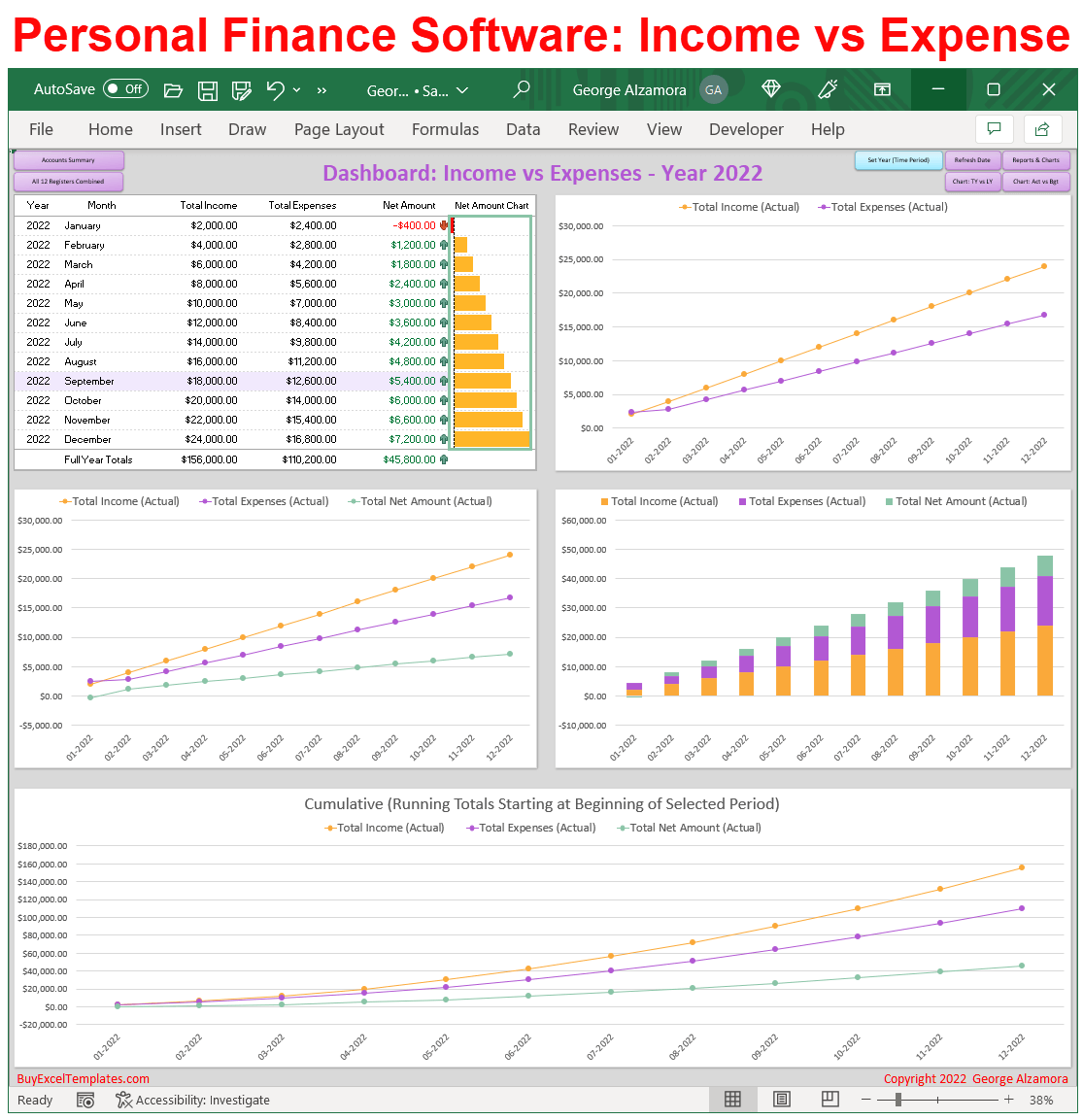

New feature #4: New: Improved the "Chart Dashboard" sheet that was introduced in the prior version. Now the "Chart Dashboard" focuses exclusively on Actual Income vs Actual Expense vs Actual Net amounts (including cumulative). Sometimes its important to just focus in on whether your actual inflows are greater than your actual outflows, to determine if you are saving money or potentially going into debt (or using up savings). The the Excel template, the current month / year income vs expense data is highlighted in the table to differentiate it from other time periods. The new Actual vs Budget Chart Dashboard will focus on budget related charts.

New feature #5: New: Improved navigation among Reports & Charts

Personal Finance Software Summary

Georges Budget for Excel is personal finance software that can benefit many people due to its simplicity and ease of getting started, Whether you are new to budgeting and just want basic feature or you are a customer looking for advanced budget tools and financial management, this software can scale up to meet your needs with features such as custom pivot table reports and charts that the user can customize from start to finish to match their particular personal finances.

Simple account reconciliation to balance your checkbook to know what your actual balance is and so you do not overdraw your checking account and reconcile your credit card account to make sure you were not overcharged or had unauthorized fraud charges on your account. You can manage up to 12 financial accounts such as checking accounts, savings accounts, credit cards accounts, loans, debts, mortgage loans, home values, investment accounts values, retirement accounts values, and more. Easily import your financial transactions via csv file.

The budgeting software lets you split transactions into multiple categories including splitting a transaction into multiple income categories or expense categories or a combinations of the two. The personal finance spreadsheet can have up to 200 different expense categories and up to 50 different income categories which are fully customizable by the user so you can edit and create your own budget categories to fit your personal finances.

System Requirements:

- PC (Microsoft Windows computer) with one of the following versions of Excel

- Microsoft Excel 2021 / Excel 2024 (one-time purchase, non-subscription)

- Excel for Microsoft 365 (previously named Excel for Office 365). (part of Microsoft 365 subscription / Office 365 subscription)

- Mac Computer with one of the following versions of Microsoft Excel for Mac.: (Not compatible with Apple iPhone or Apple iPad)

- Microsoft Excel 2021 for Mac / Excel 2024 for Mac (one-time purchase, non-subscription)

- Excel for Microsoft 365 for Mac (Excel for Office 365 for Mac) (part of Microsoft 365 subscription / Office 365 subscription).

- PC and Mac Computers should have minimum 4 GHz processor, 8 GB RAM and SSD storage. The home budgeting spreadsheet (Georges Budget for Excel v17) may work if Windows computer or Mac computer has less than these system requirements but it will be slower due to large amount of Excel formulas and the Excel template may not work.

- The money management software is supported in the United States, Canada, and Australia as amounts are formatted with the $ symbol and Dates are formatted as MM/DD/YYYY.

- If you are using a Windows computer, you need the Windows 10 or Windows 11 (64 bit versions) and Excel for Microsoft 365 or Excel 2021 (64 bit versions) as apposed to the 32 bit versions. If you are using a Mac computer, you need Mac OS (64 bit version) and Excel for Microsoft 365 for Mac or Excel 2021 for Mac (64 bit version) as apposed to the 32 bit versions.

- The Excel template is not compatible with Google Sheets (Google Spreadsheets)

- The Excel budget template is not compatible with Apple Numbers spreadsheets

- The home budgeting spreadsheet is not compatible with Microsoft's free "Excel Online" app that is part of the free Office Online apps. These online apps are web browser based and have limited features compared to the full desktop version of Microsoft Excel.

- The Excel budget template is not compatible with the Excel Mobile app whether using Android or iPhone. (Excel mobile app is part of Microsoft Office Mobile apps that allow you to use a feature reduced version of Excel on your compatible mobile phone and smaller tablet devices to review, update, and create spreadsheets). The Excel template requires one of the full desktop versions of Excel listed above in the system requirements.

- Whether you are using a PC with Windows 11, Windows 10 or Windows 8 or a Mac computer with the latest Apple macOS operating systems, the key is to make sure your operating is compatible with one of the listed compatible versions of Microsoft Excel and that your computer meets the hardware specs whether you are using a laptop computer or desktop computer.

- Excel 2021 and Excel 2021 for Mac are Microsoft software products that you only have to pay for once so that is a great alternative for those who do not want to pay for the Microsoft 365 monthly subscription service or yearly subscription service. This is because Excel 2021 and Excel 2021 for Mac have a perpetual license that you pay for once and that allows you to use the software for as long as you own it and have compatible software to run it.

License Terms and Refund Policy:

By purchasing you agree with the License Terms / Terms of Sale.

By purchasing you agree with the refund policy.

Excel is a registered trademark of Microsoft Corporation.

Video: Personal Finance Software

I use this software to track my work administering estates and for my business. It has a lot of features and is a great alternative to the more expensive accounting software. I recommend it highly.

Hi Kelly,

Thank you for your feedback and being a repeat customer of the budget software spreadsheet.

George

This is my second budget software I’ve purchased from George Alzamora. I found the v-17 version met all my needs. The built in pivot tables are great and that is what I was missing. I’ve purchased several different spreadsheets from different designers that doesn’t even come close to V17. V17 does everything you would want from just starting to build your wealth when you are young and until you retire. I’m retired and very pleased with this software.

Hi Tim,

I appreciate you choosing to use my budget software to manage your personal finances and for taking the time to leave a great review! I am glad to hear that you like the pivot tables, which are my favorite feature because they allow customers like you to be creative and make fast customizable reports that fit their financial needs.

George