Self-Employed Accounting Software

Self-Employed Accounting Software

Couldn't load pickup availability

- Extra 10% off with code SHOPSAVE10

- 10,000+ customers

- Spreadsheet Created by Owner

- One-Time Purchase: No Subscription

- Instant Download

- Fast Support: Based in USA

Track your small business income and expenses with our simple to use accounting software designed specifically for self employed individuals. The intuitive checkbook software for your small business tracks your income and expenses giving you key insights in the financial status of your business.

Benefits of the Accounting Software.

Keep track of all your personal and business checking accounts, business savings accounts, and business credit card accounts in one place for efficient management of your financial accounts.

Easy to use Excel checkbook and credit card registers that have great tools that help you reconcile your bank accounts and credit card accounts.

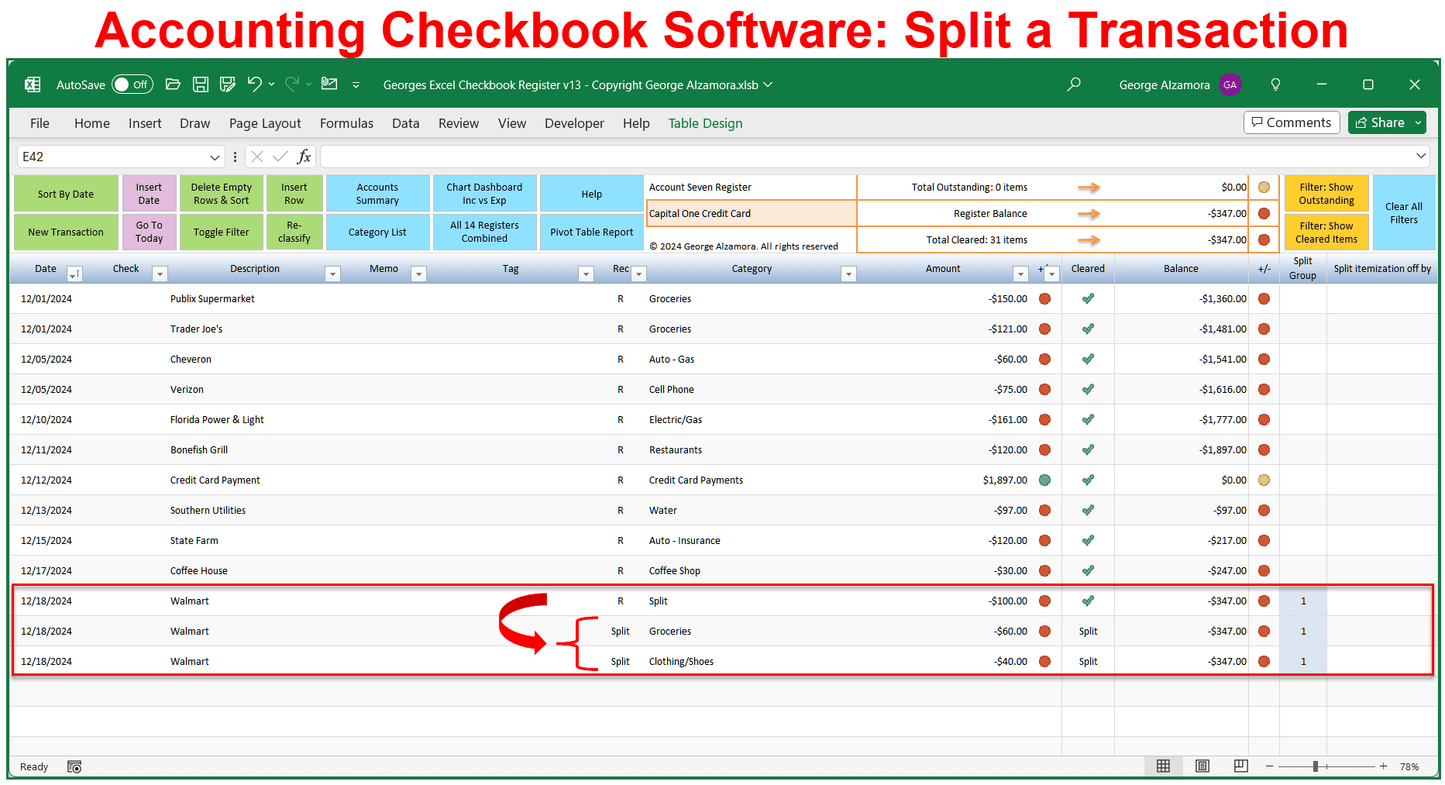

Split transactions into multiple categories in the account registers such as the Excel checkbook and credit card registers so that you can better allocate your income and expenses to the proper categories.

In addition to the individual account registers, there is an automatically generated master register that includes all transactions from all the individual account registers. The master register is a great place to filter and search for transactions based on multiple criteria.

Great customized pivot table reports to help you track your income and expenses.

Net worth tracker to track the balances of your accounts including your assets and liabilities.

Dashboards that give you a quick snapshot of your business finances saving you time.

The business checkbook software can also track your personal finances either by using one or more of the account registers for your personal accounts or by tagging transactions in an Excel register as either personal or business related. The customizable pivot table reports can create income vs spending reports for both your business finances and personal finances.

Use the self-employed accounting spreadsheet to create custom categories specific to your small business and also split transactions into multiple categories which is great if your purchase includes both personal and business related expenses or when a single purchase needs to be allocated to multiple business income or expense categories.

System Requirements and Limitations:

System Requirements and Limitations:

PC or Mac Computer with Microsoft Excel 2021 / Excel 2024 (one-time purchase, non-subscription) or Excel for Microsoft 365 (part of Microsoft 365 subscription). The accounting software spreadsheet is only supported in the United States (for use by US based small business only) as the amounts are formatted with the $ symbol and the dates are formatted as MM/DD/YYYY.

PC and Mac should have minimum 4 GHz processor, 16 GB RAM and SSD storage. The accounting spreadsheet is not compatible with Google Sheets (Google Spreadsheets). The self-employed accounting software is designed for small business that buy and sell using cash, check, wire transfers, credit cards, or debit cards and who meet the following criteria: Designed for small businesses that use the cash basis method of accounting as apposed to the accrual basis of accounting. Designed for small business that are not inventory based small businesses (do not carry inventory where you have to track Cost of Good Sold (COGS). The small business does not sell or buy on credit, such as the credit terms "payable in 30 days". The small business accounting software does not track accounts payable and accounts receivable. The small business accounting spreadsheet does not track employee payroll. The accounting spreadsheet is not designed for small businesses that publish financial statements like public companies for audit purposes. Transactions are typically recorded using simple single-entry accounting rather than double-entry accounting.

All register transactions must originate from a transaction within one of your accounts (checking, savings, credit cards) and must be assigned to one of the income, expense, or other categories such as transfers, payments, spilt transactions, etc.) Each account register has a max of 4000 rows to record transactions, some of which might be splits which would require more than one row to record a single transaction such as a purchase split between two expense categories would require 3 rows to record the single transaction.

License Terms and Refund Policy:

License Terms and Refund Policy:

By purchasing you agree with the License Terms / Terms of Sale.

By purchasing you agree with the refund policy.

Excel is a registered trademark of Microsoft Corporation.