Small Business Bookkeeping Software Spreadsheet

Small Business Bookkeeping Software Spreadsheet

Couldn't load pickup availability

- Extra 10% off with code SHOPSAVE10

- 10,000+ customers

- Spreadsheet Created by Owner

- One-Time Purchase: No Subscription

- Instant Download

- Fast Support: Based in USA

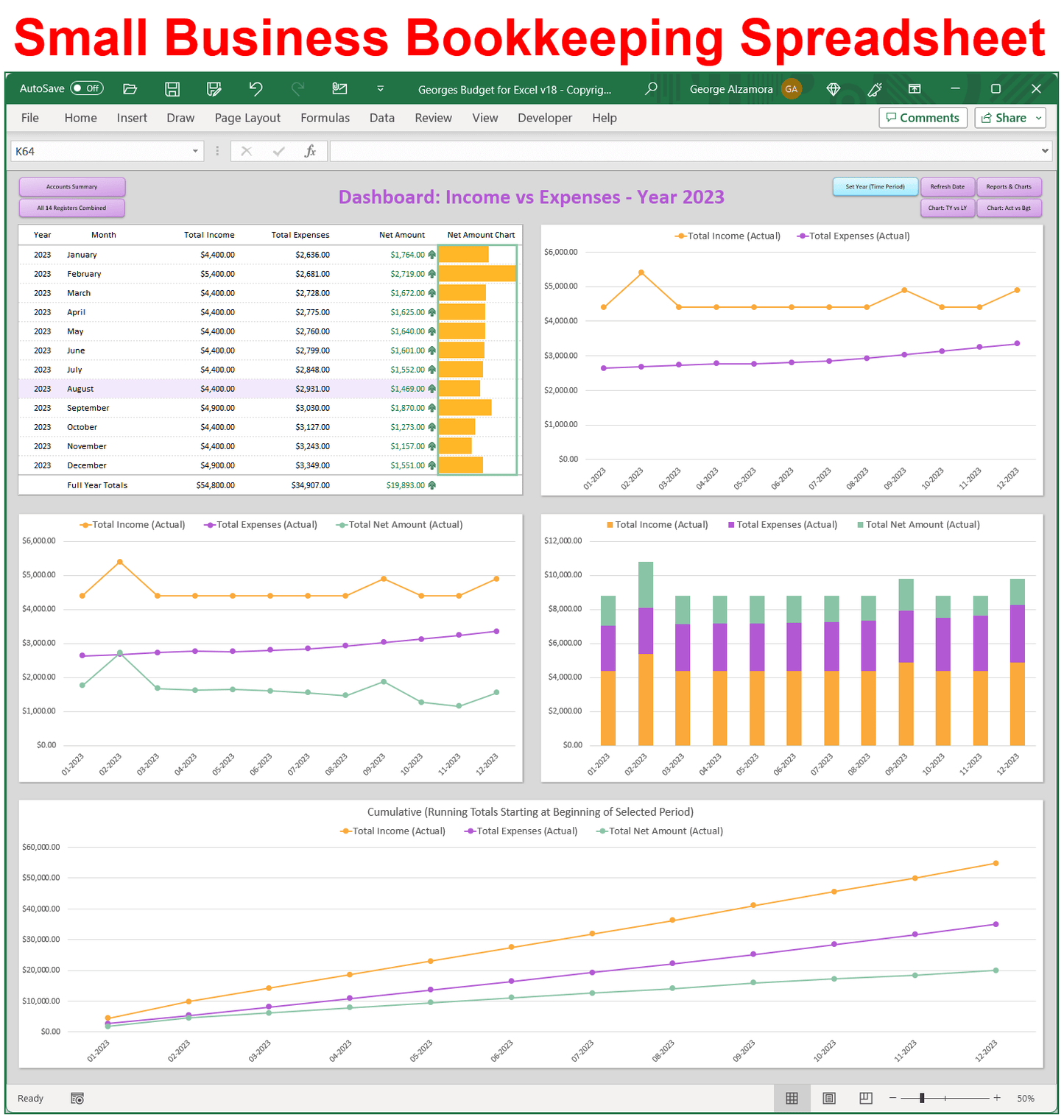

Simple bookkeeping software to help you manage your small business finances. The bookkeeping spreadsheet is a great tool to help you record your business income and business expenses. The bookkeeping spreadsheet automatically creates beautiful reports such a income statements (P/L statements), category based spending reports, vendor based spending reports, and reports to see your net income, whether you are making a net profit or net loss. The accounting software is for small businesses who use the cash basis for accounting and taxes.

Top features of the bookkeeping software:

- The spreadsheet business bookkeeping software allows you to keep track of 14 business accounts including business checking accounts, business savings accounts and credit card accounts in the Excel registers.

- Record business income and business expenses in one of the 14 accounts registers depending on which account is impacted.

- Tools to help you reconcile your bank accounts and credit card accounts to make sure your accounts are in balance

- Includes a Master Register that automatically combine all your transactions from the individual 14 accounts so that you can search and filter for transactions in a single register from all your accounts.

- Each register can filter and get subtotals.

- Includes several Excel dashboards focusing in on account balances and income and expenses.

- Automatic reports: The business software automatically created monthly and year income statements (income vs expense reports) based off the transactions that you enter into the registers.

- Custom reports: There are custom pivot table reports that instantly create reports based on the data in the registers but you can also customize the reports. For example, you can create a spending report of total expenses on a quarterly basis.

- You can create your own categories that you assign to transactions. You can add up to 50 income categories to track your business revenues and sales and up to 200 expense categories to track your business expenses.

- Business account transactions can be split into multiple categories giving you greater flexibility to accurately tag your income and expenses to the appropriate categories for best bookkeeping practices.

- The business bookkeeping software is designed for small business such as the self employed, unincorporated freelancers, single person LLC business (small businesses that are not incorporated) who use the cash basis of accounting to manage their finances. For example, an individual who is self employed and runs a maid cleaning service who paid in cash on the day the cleaning services are performed.

- The bookkeeping software for self employed allows you to set a monthly budget for each income and expense category so you can compare you monthly budget to actual income and expenses. Easily budget your business expenses for the entire year to help keep you organized and develop a business budget plan.

- The bookkeeping software is a great way to manage your business checkbook using an Microsoft Excel checkbook register.

- The small business bookkeeping is simple checkbook software where you can tag each transaction with a custom category and quickly create business income vs expenses reports.

System Requirements and limitations:

- PC (Microsoft Windows computer) with one of the following versions of Excel

- Microsoft Excel 2021 or Excel 2024 (one-time purchase, non-subscription)

- Excel for Microsoft 365 (Excel for Office 365) (part of Microsoft 365 subscription / Office 365 subscription)

- Mac computer with one of the following versions of Excel

- Microsoft Excel 2021 for Mac or Excel 2024 for Mac (one-time purchase, non-subscription)

- Excel for Microsoft 365 for Mac (Excel for Office 365 for Mac) (part of Microsoft 365 subscription / Office 365 subscription)

- The monthly bookkeeping spreadsheet is only supported in the United States (for use by US based small business only) as the amounts are formatted with the $ symbol. The dates are formatted as MM/DD/YYYY.

- PC and Mac should have minimum 4 GHz processor, 16 GB RAM and SSD storage. The business bookkeeping spreadsheet (Small Business Bookkeeping Software) requires those specs to run properly due to large amount of Excel formulas.

- The bookkeeping spreadsheet is not compatible with Google Sheets (Google Spreadsheets)

- The Excel bookkeeping / monthly budget template is not compatible with Microsoft's free "Excel Online" app that is part of the free Office Online apps. These online apps are web browser based and have limited features compared to the full desktop version of Microsoft Excel.

- The accounting software is designed for small business that buy and sell using cash, check, wire transfers, credit cards, or debit cards and who meet the following criteria:

- The small business uses the cash basis method of accounting as apposed to the accrual basis of accounting.

- The small business is not an inventory based small business (does not carry inventory where you have to track Cost of Good Sold (COGS)

- The small business does not sell or buy on credit, such as the credit terms "payable in 30 days".

- The small business does not use accounts payable

- The small business does not use accounts receivable

- The small business does not have employees

- The small business does not have payroll

- The small business does not publish financial statements like public companies for audit purposes

- Transactions are typically recorded using simple single-entry accounting rather than double-entry accounting.

- All register transactions must originate from a transaction within one of your accounts (checking, savings, credit cards) and must be assigned to one of the income, expense, or other categories such as transfers, payments, spilt transactions, etc.)

- Each account register has a max of 4000 rows to reports transactions some of which might be splits which would require more than one row to record a single transaction such as a purchase split between two expense categories would require 3 rows to record the single transaction.

License Terms and Refund Policy:

By purchasing you agree with the License Terms / Terms of Sale.

By purchasing you agree with the refund policy.

Excel is a registered trademark of Microsoft Corporation.